RIA 2.0: Less Paperwork, More Personal Connections

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

Is your use of AI fully compliant with the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC) rules and regulations? This is Part One of a multi-part series on making your AI notetaking tools compliance-ready—starting with the rules around recording conversations.

Throughout my career building secure and scalable tech—especially in cybersecurity—I’ve seen firsthand how crucial it is to lead with compliance. For wealth management firms exploring AI notetaking, regulatory readiness can’t be an afterthought.

In my next few posts, I’ll share how you can stay compliant when you use AI notetaking tools, including obtaining consent for recordings, retaining recordings and conversational data, and confirming the accuracy of recorded information.

Let’s start here by drilling down on one specific aspect of compliance as it pertains to AI notetaking—consent.

Do You Have Your Clients’ Consent for Recording Conversations?

Although consent is not explicitly mentioned within the rules of FINRA and the SEC, advisors must understand and abide by their respective state’s privacy laws. Such laws clearly outline how many parties within a conversation must give their consent to be recorded. Generally, state law on audio recordings falls into one of two categories: they either require single-party or dual-party consent.

Advisors in California, for example, must abide by all-party consent, meaning everyone in the meeting must agree to be recorded. In New York, however, advisors can abide by one-party consent, in which only one person must give their consent to be recorded.

Since laws vary by state, every advisor should obtain the necessary consent to ensure that their client interactions are not only compliant but also protect the privacy of every participant. This also helps strengthen the advisor’s relationships with their clients—it’s the right thing to do.

FINRA’s View

FINRA has not issued specific guidance on consent for recordings but does require firms to follow all applicable federal and state laws. According to FINRA Rule 3170, certain RIAs (particularly those affiliated with firms that have a high percentage of registered representatives subject to regulatory actions) must:

“Make and retain a record of all telephone conversations (both incoming and outgoing) with customers and counterparties that relate to…securities transactions, the performance of services by the member, and other communications that are required to be recorded under applicable laws or regulations.”

This means any recorded telephone conversation—including virtual meetings—requires RIAs to obtain the consent of their participants to record in a way that abides by their state’s wiretapping laws.

SEC’s View

Under SEC Rule 17a-3, broker-dealers must:

“Make and keep, in an easily accessible place, for at least three years, the records required by this section, including records of communications with customers.”

If advisors are to meet this standard while also complying with FINRA Rule 3170, they must ensure that clients and other participants have explicitly consented to being recorded.

The Bottom Line on Consent

Confirming client consent is not just a best practice—it’s essential. Failing to do so can expose your firm to reputational and regulatory risk.

That’s why our AI notetaking software, Parrot by Advisor360°, is built with transparency, privacy, and participant control at its core.

These safeguards help every participant feel comfortable and respected—while reinforcing trust with your clients.

At Advisor360°, we build AI and automation with compliance in mind—from secure data capture to configurable oversight tools. Our solutions not only increase productivity but are engineered to align with evolving regulatory guidance.

If this topic is relevant to you, make sure to also read my blog on Three Questions to Ask Your AI Vendors.

Ready to experience secure, compliance-conscious AI notetaking? Start your Parrot by Advisor360° 14-day free trial here.

Paul Morville is Co-founder of Parrot AI and Product Architect at Advisor360°.

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

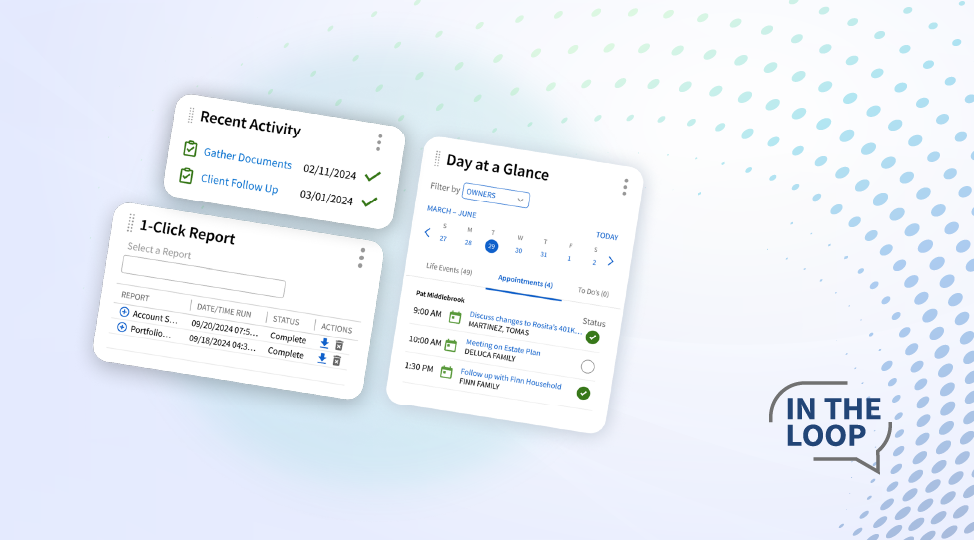

Picture this: You’re prepping for a client meeting—switching between several systems at once to locate client details, account balances, and...

According to our 2025 Connected Wealth Report, 85% of advisors believe generative AI will help their business—that’s up from 65% in 2024.