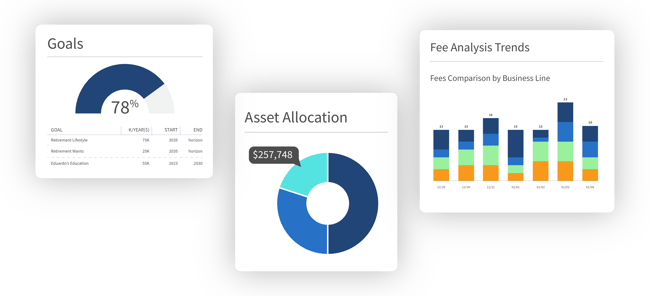

Unify data across financial wealth management platforms

Optimize existing investments and unify data across all systems in the technology stack with our open wealth management platform. With technology partners spanning across categories, we create a frictionless, 360-degree view of households.

The benefits of an open, integrated wealth management platform

Relying on a wealth management software that is dependent on multiple third-party solution providers can derail workflows, processes, and general productivity.

Advisor360°’s open, configurable platform allows you to manage the wealth needs of all stakeholders and all lines of business while seamlessly integrating with our flexible solutions, a partner ecosystem, and your existing technology stack.

Work with your existing tech stack

Powered by our Unified Data Fabric, our open and integrated platform architecture complements the applications you already rely on.

CRM

Redtail

Wealthbox

Salesforce

MS Exchange / Outlook

Research & Planning

CFRA

Argus

RightCapital

MoneyGuide

Morningstar

YCharts

Fi360

Data & Custodian

Fidelity

BNY Mellon Pershing

Charles Schwab

DST Global

DAZL™

DTCC

Ice

Factset

Yodlee

TAMPs

Annuities

Insurance

Insurance & Account Opening

iPipeline®

Hexure, FireLight

ASH Brokerage

DocuSign

QuIK!

MassMutual Coverpath

Trading SMA/UMA

LSEG

Wealthscape™

Envestnet

Refinitiv (LSEG)

Charles River

Tax & Finance

Intuit, TurboTax

H&R Block

Quicken

TaxAct

Marketing

Broadridge

twilio

fmgsuite

Explore our integrations

Optimize existing investments and unify data across all systems to accelerate account planning and creation, expand access to research, and simplify tax and personal finance management.

-

CRM integration

Our powerful CRM integration engine connects seamlessly to your CRM of choice, whether that is Salesforce, Redtail, or even a proprietary system. We also offer integration/synchronization at the Microsoft Office 365/on-prem Microsoft Exchange level, so you can leverage the investments you have already made to their fullest.

-

Insurance

Leverage our insurance marketplace to facilitate and track new account openings

We provide efficient insurance product opening workflows to automate and monitor new sales, improve business efficiency, and produce faster growth for your advisors’ practices. Advisors initiate an account opening using our digital onboarding capability that automatically pre-fills data on required forms sent directly to iPipeline®, FireLight®, or Coverpath. Advisors then select from a breadth of insurance products within these configurable warehouses to complete the new account opening process and electronically request required client signatures. Principal review teams are automatically notified when client-signed variable annuity documents are available. Advisors seamlessly monitor other pending policies directly in the Advisor360° platform alongside existing policies and access completed packets in our document vault to complete the workflow.

-

Planning

Streamline creation of financial plans by seamlessly exporting household data into a preferred planning tool

Our platform is pre-integrated with leading financial planning tools, including MoneyGuide® and RightCapital. Our integrated document vault enables simplified and secure sharing of financial plans with clients, as well as a consolidated view of your financial plan with other key documents and reports. Export household data into eMoney or other planning tools with a single click, reducing manual data entry and improving data accuracy.

Data passed from Advisor360° to planning tools includes:

- Household demographic information

- Investments

- Insurance

- Liabilities

- Aggregated data

- Other assets

-

Research

Access leading market, corporate, and industry research

We integrate with industry-leading market data firms, providing easy access to market, corporate, and industry research. We offer single sign-on access to Argus Research Company, Value Line, Broadridge®, and CFRA Research. Integration with Morningstar® Advisor Workstation℠ provides full access to tools and one-click export of holdings, as well as the import of individual snapshot reports. We also partner with FactSet®, providing benchmark data, pricing, and other security reference data. We also pull account balances, holdings, and transactions from National Financial Services and send them to Quicken® for personal financial management purposes.

-

Tax and Finance

Our platform connects seamlessly with leading tax preparation tools, including TaxAct®, TurboTax®, and H&R Block®.

Tax data for a household is automatically imported into the tax software, pre-filling relevant fields to reduce manual data entry and improve data accuracy. Data passed from Advisor360° to tax preparation tools includes current tax year requirements on 1099 data.

Ready to get started?

See how we unify data across financial wealth management platforms.