Using technology that was included with clearing firm arrangements and didn’t meet your needs

Deliver connected experiences with our wealth management platform

Our platform powers end-to-end operational efficiency with workflows that move seamlessly across connected capabilities (e.g., financial planning) and services (e.g., reporting) powered by a unified data layer known as our Unified Data Fabric® (UDF).

How many of these problems sound familiar?

Our configured offerings meet immediate needs across investment, insurance, and banking products and grow with your business. Each offering eliminates the need to rely on:

Assembling vendor solutions to build a custom integration that has to be maintained

Building a complex solution that was time consuming and didn’t accomplish the main objective

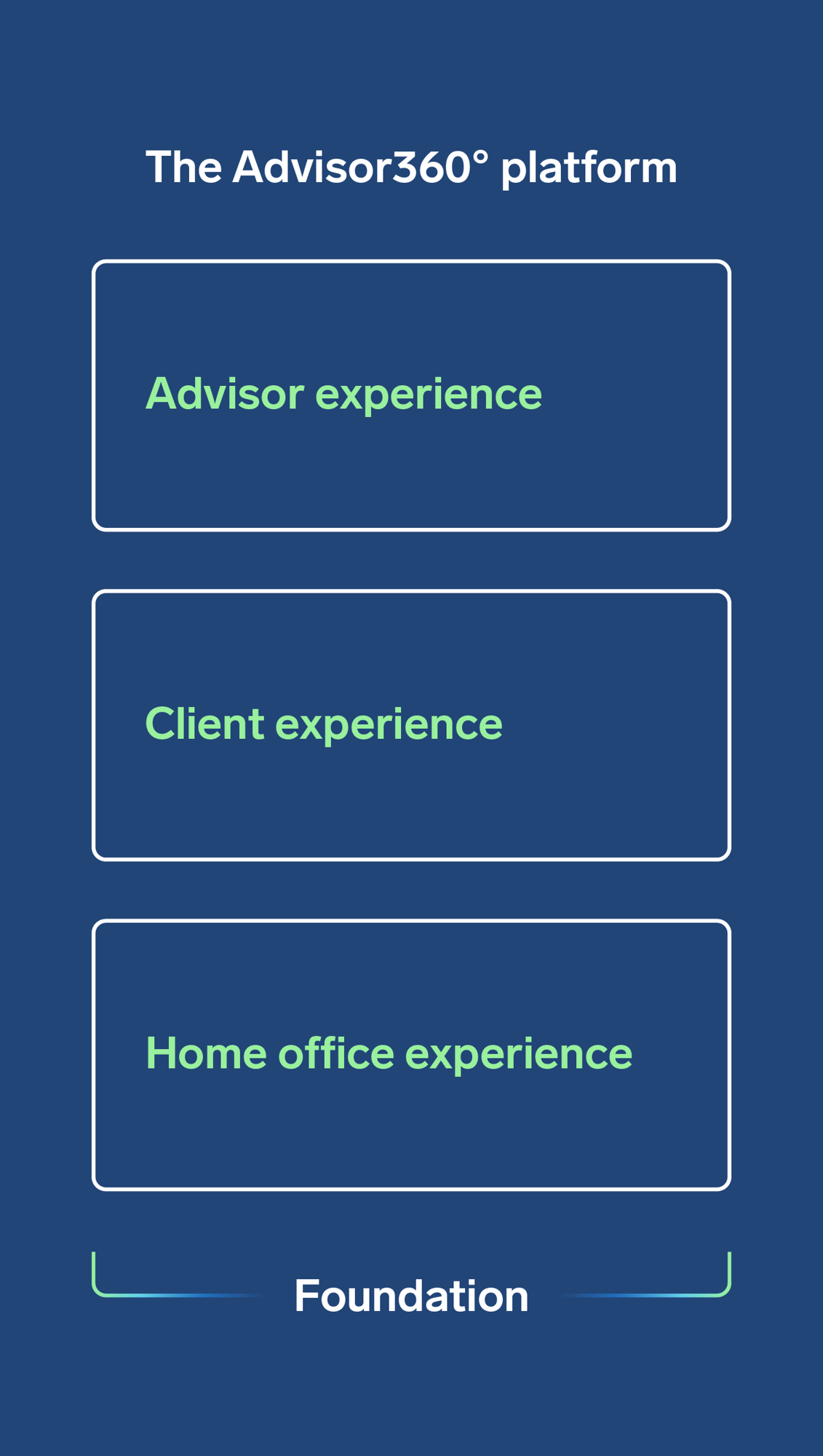

Connected experiences for advisors, clients, and your home office staff

Our platform runs three distinct connected experiences; configurable, easy-to-use interfaces; and dashboards that dynamically combine UDF data with the features, capabilities, and integrations required for the specific needs of each user.

Our advisor experience allows advisors to manage and grow their book of business in one place.

Advisor dashboard

Advisors easily configure their own personalized dashboards, widgets, saved searches, user-defined work processes, and team collaboration.

1-Click Reviews®

Bundle individual reports so your advisors can give clients a personalized, curated story at scale with the click of a button.

Portfolio & performance reporting

Digital and PDF access to account balances, holdings, activities, and performance on an advisor’s book of business, specific households, or client.

Financial planning

Enables advisors to develop a financial plan based on a client's goals and conduct scenario analysis based on defined assumptions.

Proposal generation

Enable advisors to deliver a proposed recommended investment strategy to clients based on their risk profile and investment objectives.

Insurance

Aggregated view of all types of life insurance, long-term care, disability, and annuities. Integrated illustrations and applications make it easy to add products to a client’s portfolio.

Trading & model management

Create models at practice, group, household, and account levels based on clients' goals and preferred allocations and conduct trades to rebalance models.

Customer relationship management

Manage all aspects of the relationship with the client, including contact information, opportunities, and capturing all interactions.

Digital onboarding

Simple, fast, and more accurate way for financial advisors to onboard clients and get them to benefit from financial recommendations.

Document management

Manage secure creation, modification, sharing, imaging, e-Delivery, and searching of all investment documents between advisors, the home office, and clients.

Workflows

Template repeatable groups of activities that represent work-related processes. Use our drag-and-drop to create dependencies and assign tasks.

Alerts

Provide advisors, home office, and clients with notifications by email, text, and through dashboards on specific actions that occur within the Advisor360° platform.

Activity management

Manage and track all interactions (appointments, trades, planning) between advisors and clients throughout the platform to provide fuller context to client relationships.

Fee billing

Stores advisor fee schedules and calculates and reports on fees with integrations back into your compensation system.

WealthGuide®

Streamline, optimize, and templatize financial planning with our comprehensive process development tool, WealthGuide.

Our client experience lets advisors’ clients see integrated, holistic views of their complete financial lives through a simplified interface.

Client dashboard

Empowers investors with a secure online portal to view their accounts, review performance, assets, and holdings.

Portfolio reporting

Configurable view into account balances, holdings, and activities with options to provide access to performance or more enhanced reporting.

Insurance

Aggregated view of all types of life insurance, long-term care, disability, and annuities. Integrated illustrations and applications make it easy to add products to a client’s portfolio.

Account aggregation

Provides a complete view of a client’s financial life by linking outside investment, banking, insurance, loan, mortgage, and credit card accounts to the client and advisor portals.

Document management

Manage secure creation, modification, sharing, imaging, e-Delivery, and searching of all investment documents between advisors, the home office, and clients.

Secure messaging

Securely communicate and share files with clients with real-time notifications when new messages are received.

Our home office experience allows firms to efficiently run their broker-dealer/RIA with configurable features that adapt to their business.

Case management

Home office can create, modify, and manage cases throughout the platform to ensure expedited and on-policy communication between advisors and clients.

Advisor information

Centralized view of advisors’ contact info, IDs, licensing, designations, and continuing education information.

Entitlements manager

Powers your hierarchy model and offers fully configurable, role-based permissions that grant or deny access to applications and information.

Operations

Operations enables support of investment account setup/maintenance and straight-through processing of updates to investment accounts.

Compliance

Ensure adherence to the regulatory requirements for different business lines and affiliations.

Unified Data Fabric

Our Unified Data Fabric is a proprietary data model that collects and enriches all types of data from hundreds of sources (including contract data, accounts and trusts, insurance, holdings, and transactions) and consolidates, cleanses, and curates it into a rich, unified format that flows freely through our enterprise-class platform of connected wealth management experiences.

What’s more, the UDF is continually reaching out to monitor and refine the data in our platform, so it's always up to date, whether it’s global market moving trends or more subtle items such as changes to an individual’s job status.

Speak with our experts

Learn how our platform can help your agents improve communications and enable recommendations in the best interest of households.