RIA 2.0: Less Paperwork, More Personal Connections

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

Financial advisors wear so many hats: Life coaches. Business partners. Community members. But many are also business owners and builders, managing the financial health and growth of their practice.

Being a responsible business builder and owner means putting on your CFO hat and tracking KPIs (key performance indicators) to drive decision-making. AUM, of course, remains the gold standard metric for measuring firm growth and health year-over-year, but there’s a lot of nuance to consider.

According to annual research from The Ensemble Practice, advisory firms reported record profitability in 2024. On average, revenue growth was 15.3%—but that upbeat figure was driven largely by market appreciation. Whereas, organic growth (new client relationships) declined from 5.7% in 2023 to 4.1% in 2024.

As an advisor, you can’t control the market—but you can track meaningful KPIs to help measure and drive growth. Based on our conversations with advisors, we believe the most meaningful metrics are more about clients than about assets managed.

These are some of the KPIs that we think will help you track the health and sustainability of your business while also strengthening your relationship with clients.

Time Spent With Clients and Prospects

For many advisors, the whole point of being in the business is to spend more time engaging in meaningful dialogue—not only with clients but also with prospective clients. Tracking the actual hours you and your team dedicate to client meetings, prospect interactions, and relationship-building touchpoints is one of the most powerful ways to measure efficiency.

Yet, according to research from Kitces.com, only 20% of the average advisor’s workweek is spent in client meetings, while nearly two hours of preparation and follow-up are required for every one hour of client-facing work. Advisors who can automate meeting prep, streamline paperwork, and digitize compliance find they can redirect those hours each week into deeper client conversations and more consistent prospect engagement.

It’s more than a feel-good metric—time spent with clients directly correlates with trust, loyalty, and referrals. And time spent with prospects is a direct growth lever. Together, these interactions also reveal whether your tech stack is working for you or against you. Time spent with clients and prospects will make it obvious if you’re bogged down in manual tasks. In many ways, “time with clients and prospects” is the most honest indicator of practice efficiency and growth—it shows whether you’re operating like the advisor you want to be.

Client Retention Rate

While asset growth dominates performance discussions, client retention is the more durable indicator of a healthy practice. According to Schwab’s 2024 RIA Benchmarking Study, firms self-report 97% annual retention rates, underscoring the industry’s remarkably “sticky” relationships. Even a small decline in that figure has outsized consequences: research demonstrates that reducing retention from 97% to 92% can shorten the average client relationship from 30 years to just 12.

Tracking retention rate forces an advisor to look past market returns and ask whether clients feel consistently well served. High retention reflects both technical competence and the advisor’s role as a trusted guide. It is also one of the most direct predictors of organic growth—since firms that keep clients longer are better positioned to benefit from referrals and intergenerational planning opportunities.

The bottom line is that measuring client retention gives you actionable insight into where your service model is thriving and where it might be falling short.

Client Referral Rate

Referrals are one of the most powerful and cost-effective growth engines for RIAs. According to Cerulli, 53% of new clients come from referrals—far more than from marketing or digital channels. Unlike AUM, which can rise and fall with market returns, referrals are a direct reflection of client trust.

Tracking how likely clients are to recommend your services—via Net Promoter Score (NPS) survey or by monitoring referral activity—provides a client-centered measure of practice health and future growth. It also helps advisors identify advocates within their book of business and strengthen those relationships.

Over time, referrals compound like assets, creating an organic growth engine more sustainable than market appreciation. A high referral rate signals that clients value your advice and believe the experience you provide is worth sharing with family and friends—opening a pathway to next-gen clients as an estimated $124 trillion in wealth transitions over the next 25 years.

These aren’t the only client-centric metrics that matter. Beyond time with clients, retention and referrals, there are additional ways to measure the depth and durability of client relationships—metrics that capture not just firm size, but loyalty, profitability, and long-term sustainability.

For instance, share of wallet (SOW) highlights how much of a client’s financial life you truly oversee. On average, firms manage just 39% of a client’s investable assets, with the rest held at banks, other managers, or in self-directed accounts. A growing share of wallet is a strong signal that clients see you as their primary advisor—not simply one of many—deepening loyalty and profitability while making service delivery more efficient.

Another useful lens is the lifetime value to client acquisition cost (LTV:CAC) ratio. When lifetime client value far exceeds acquisition cost—fueled by referrals, cross-selling, and multi-generational planning—firms are positioned to grow profitably and sustainably over the long term.

Real growth isn’t just about AUM; it’s about the clients you keep and how you grow those relationships. AUM will always matter, but it tells only part of the story.

If these ideas resonate with you, I invite you to schedule a fast and easy demo to see how Advisor360° could improve your practice. Better yet, let’s connect - send me a message on LinkedIn and I’d be happy to chat.

JP Nahmias is Vice President of Product Management at Advisor360°.

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

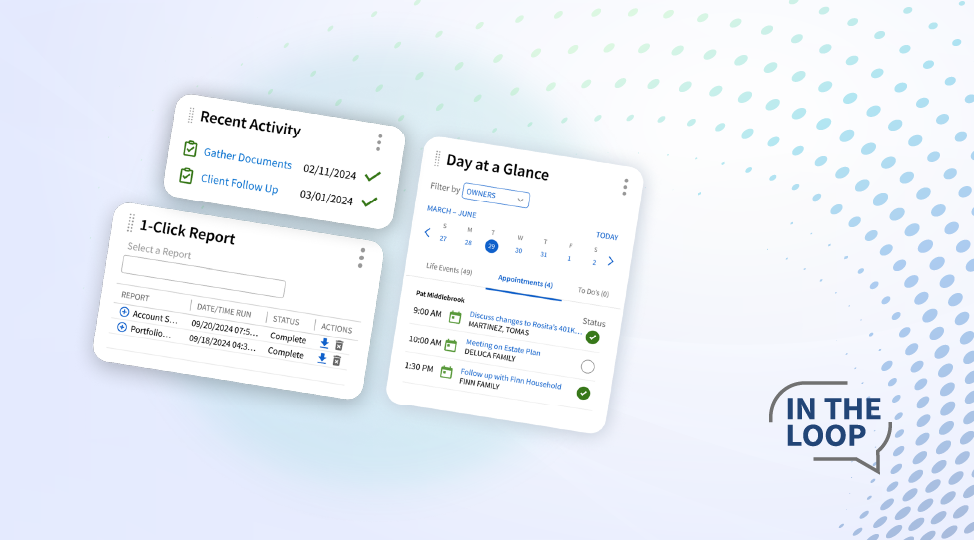

Picture this: You’re prepping for a client meeting—switching between several systems at once to locate client details, account balances, and...

According to our 2025 Connected Wealth Report, 85% of advisors believe generative AI will help their business—that’s up from 65% in 2024.