RIA 2.0: Less Paperwork, More Personal Connections

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

3 min read

Caitlin Rouille : 7/17/25 9:16 AM

The connection between advisors and clients is built on conversations that go beyond the numbers. Thoughtful technology and mindful design can support those moments by making it easier for advisors to uncover what matters most to their clients and respond with clarity and confidence.

Seeing beyond the plan

Markets are unpredictable, and so are people.

When portfolios drop, clients may feel anxious. When markets surge, they may feel overconfident. These emotions can influence decisions in ways that don’t always align with an investor’s long-term financial plan.

Some of the most impactful conversations I’ve observed happen when advisors help clients step back from the noise and refocus on their goals. These moments are where trust is built and where an advisor’s role as a guide comes through most clearly.

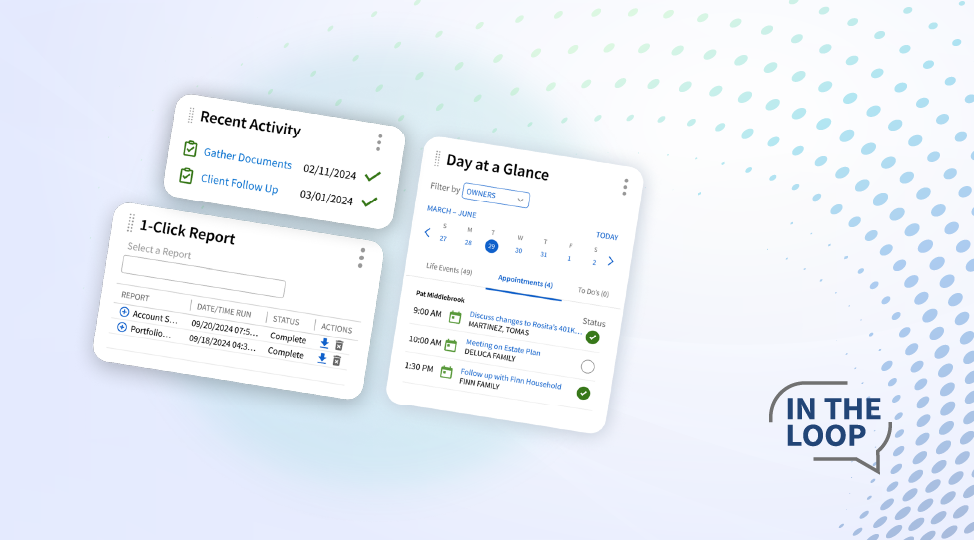

Technology can play an important role here. It can surface behavioral patterns and emotional cues that might otherwise go unnoticed and help advisors prepare for meaningful conversations at just the right time. Rather than replacing the personal connection, well-designed WealthTech strengthens it by providing context, insight, and a clearer view of what matters to the client.

A personal story: more than numbers

One of the moments that shaped how I think about advisor-client relationships happened in my own family.

A close family member with a son who has special needs faced challenges that didn’t fit neatly into a typical financial plan. Their advisor listened closely, asked thoughtful questions, and offered solutions they hadn’t considered. Over time, he became someone they could truly rely on, not just for advice but for support through some of the toughest conversations they’ve had.

That experience stayed with me because it showed what meaningful guidance looks like. Technology has the potential to make that kind of guidance more accessible by surfacing client fears and priorities, highlighting when conversations need to happen, and giving advisors ways to frame them effectively. When designed well, technology helps advisors approach these moments with confidence and empathy, helping them show up prepared, thoughtful, and indispensable.

Designing technology to help advisors shine

For those of us building technology and workflows for advisors, the goal is not to tell advisors how to do their jobs. The goal is to support what they already do best—connect with clients and make it easier to navigate the most challenging situations.

Here are some of the user-centered design principles we focus on to help advisors shine:

These principles, which we use on our own platform, are grounded in user-centered design research with advisors and clients alike. They ensure that technology feels intuitive, fits naturally into an advisor’s workflow, and provides the right information at the right moment without getting in the way.

Final thoughts

When we design technology that supports these moments, we aim to give advisors the clarity, empathy, and confidence to show up fully when it matters most.

Meaningful conversations are rarely about the market. They are about a parent quietly wondering about their child’s future, or a spouse asking if they’ll be okay after a life-changing diagnosis.

Advisors feel the weight of these moments. Thoughtful design, from intelligent workflows to clear insights and intuitive interfaces, can help them carry that weight. It provides the support and guidance they need to listen, respond, and reassure their clients when it counts.

We keep that in mind with everything we build, creating technology that strengthens trust and helps advisors continue to shine in the moments that define their relationships for years to come.

Caitlin Rouille is Director of Product Design at Advisor360°.

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Picture this: You’re prepping for a client meeting—switching between several systems at once to locate client details, account balances, and...

According to our 2025 Connected Wealth Report, 85% of advisors believe generative AI will help their business—that’s up from 65% in 2024.