RIA 2.0: Less Paperwork, More Personal Connections

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

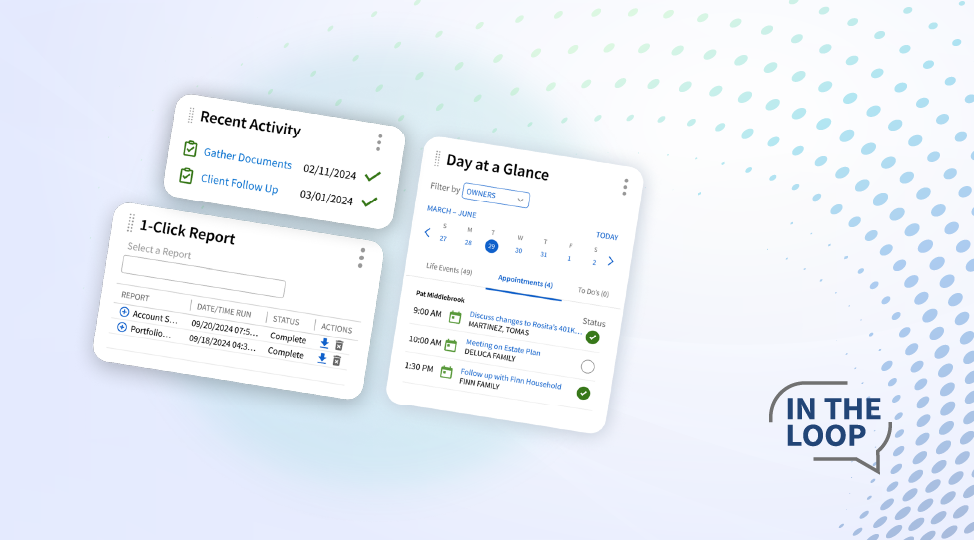

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

3 min read

Mohit Daga : 9/25/25 10:50 AM

.png)

Wealth management is at a pivotal moment. For decades the industry has been guided by instinct and tradition. Every advisor interaction, client login or report run leaves behind signals—small on their own, but collectively an untapped source of discovery powerful enough to reshape how firms grow, retain and serve.

Signals of what’s next are already visible: When advisors increasingly adopt new technology, it points toward efficiency gains, when clients reduce activity it foreshadows retention risk, or when households consolidate assets it signals wallet share opportunities. When younger generations favor mobile-first engagement or robo advisors while older clients remain anchored to in-person interactions, it signals more than preference—it maps the contours of future service models that firms must design around. When advisors redirect time from transactions toward holistic planning and guidance, it is not a subtle shift but a redefinition of value itself, one that elevates advice from a product to an enduring relationship. These signals are part of a broader narrative about how advice is evolving. What has been missing is the lens to interpret them and translate them into foresight that can guide the industry forward.

Why This Matters

The industry is moving beyond historical reporting. What is emerging is forward-looking intelligence that provides better opportunities, strengthens loyalty and sharpens alignment between advisors and clients. Discovery in this space points toward new possibilities to:

These discoveries are not theoretical. They represent opportunities to bring more clarity to how advisors succeed, how clients build confidence and how firms position themselves for sustainable growth.

A Shift in Perspective

The data has always been there but it has rarely been used in ways that unlock foresight at scale. With advances in technology, the opportunity is to shift from measuring activity to interpreting meaning, and from looking backward to looking ahead—at scale. This change in perspective has the potential to transform how advice is delivered and how value is created. It can help firms see patterns earlier, adapt faster and guide both advisors and clients with more confidence.

Consider advisor retention risk. Historically, firms recognized an advisor was disengaging only after they had submitted a resignation. Today, subtle signals like fewer logins to platforms, a drop in engagement with firm-led campaigns, or reduced engagement with peers can be pieced together to flag risk months earlier. In the same way, client churn can be predicted not just by account withdrawals but by changes in meeting cadence, slower response to digital outreach, or even sentiment analysis of conversations between clients and advisors. Growth opportunities surface when data shows which advisors are consistently expanding wallet share within households and which need support replicating those behaviors. Each of these patterns holds practical implications for how firms retain talent, build trust and drive growth.

This shift is about creating intelligence that connects dots across seemingly unrelated data points. When framed correctly, these perspectives empower leaders to deploy resources strategically—focusing retention teams on at-risk relationships, directing training to advisors struggling with adoption, or targeting new products to clients who are most likely to benefit. In every case, the perspective gained from signals enables firms to be proactive rather than reactive.

The Path Forward

The future of wealth management will be shaped by insights already within reach. A future where advisors have intelligent support to help them grow with confidence. A future where firms strengthen relationships proactively. A future where clients feel more deeply understood and more connected to the value of advice.

What makes this path forward different from past waves of innovation is its universality. These discoveries are not limited to the largest firms or most sophisticated advisors—they are present in every firm’s existing activity data. Unlocking them requires intentional focus, not massive reinvention. It means embracing modern platforms, encouraging adoption, and aligning teams around the idea that every signal holds potential meaning.

This blog is the first in a series exploring how discovery through data can reshape wealth management. The signals are waiting to be unlocked. In future blogs, we’ll explore how firms can act on them to reduce churn, improve efficiency and create sustainable growth. We will dive into specific challenges such as predicting advisor and client retention, identifying efficiency breakthroughs, and uncovering new avenues for advancement—demonstrating how data-driven discovery provides practical answers. The goal is not just to imagine the future of advice, but to equip the industry with a framework for leading it.

If these ideas resonate with you, I invite you to schedule a fast and easy demo to see how Advisor360° could improve your practice. Better yet, let’s connect - send me a message on LinkedIn .

Mohit Daga is Group Product Leader at Advisor360°.

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Picture this: You’re prepping for a client meeting—switching between several systems at once to locate client details, account balances, and...

According to our 2025 Connected Wealth Report, 85% of advisors believe generative AI will help their business—that’s up from 65% in 2024.