RIA 2.0: Less Paperwork, More Personal Connections

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

2 min read

Caitlin Rouille : 10/2/25 9:17 AM

Technology transitions need to be carefully orchestrated, but they don’t have to derail advisors or their teams. Here’s how to thread that needle.

Change isn’t theoretical—it collides headlong with everyday business. This is as true in wealth management as anywhere: advisors are occupied with back-to-back client meetings, operations teams are racing to close the books, and the home office is juggling compliance and reporting responsibilities. None of this critical work can pause, or even slow down, when a new platform is rolled out. That’s why technology transitions can be like rebuilding the plane in mid-flight.

The reality is that standing still carries more risk than moving ahead.

Holding on to legacy systems is easier in the moment than making a change, but over time, inertia creates bigger challenges. When your tech fails to keep up, standard operating procedures bend under the weight of workarounds, making it difficult for teams to stay consistent. Exceptions start to pile up, leading to duplicate data entry, increased errors, and compliance headaches.

In other words, the longer firms wait to modernize, the less reliable their workflows become. This shows up in how advisors feel about their tools. Our recent research shows:

In other words, waiting to make a change or upgrade isn’t playing it safe. The cost is paid out in growth, trust, and retention.

People are naturally on pins and needles when a new platform or core solution is rolled out. Advisors worry about losing client time. Operations staff worry about data syncing. Technology teams are nervous about supporting a new platform they may be unfamiliar with. The home office worries about compliance gaps. And these are just a few of the concerns. The common denominator: Can we keep serving clients seamlessly while the ground shifts?

The answer lies not just in training, but in things like structured, role-specific onboarding that starts early and builds confidence step by step. A few of the most effective practices we put in place with our clients include:

When onboarding is approached the right way, transitions stop feeling like interruptions and start feeling like extensions of the work teams already know how to do.

Firms that thrive during transitions protect continuity while embracing change. Training sessions are timed to preserve client-facing hours. New processes are tested with live accounts before scaling. SOPs are updated in real time so staff aren’t juggling sticky-note instructions. Advisors get plain-English talking points to reassure clients. Bite-sized content on key functionality or weekly drip campaigns keep support ongoing as advisors adapt. These aren’t flashy moves. Put together, they send a clear signal: the business keeps running while the stack shifts underneath.

Technology transitions are complex, but they don’t have to derail advisors, operations teams, or the home office. The right partner brings the focus and continuity firms need to emerge stronger—reducing errors, tightening compliance, and giving advisors and staff confidence in the tools that power client relationships.

If the above points resonate with you, I invite you to schedule a fast and easy Advisor360° demo and see for yourself how it works. Better yet, let’s connect – send me a message on LinkedIn and I’d be happy to chat about how Advisor360°’s signature White Glove onboarding makes technology transitions manageable.

Caitlin Rouille is Director of Product Design at Advisor360°.

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

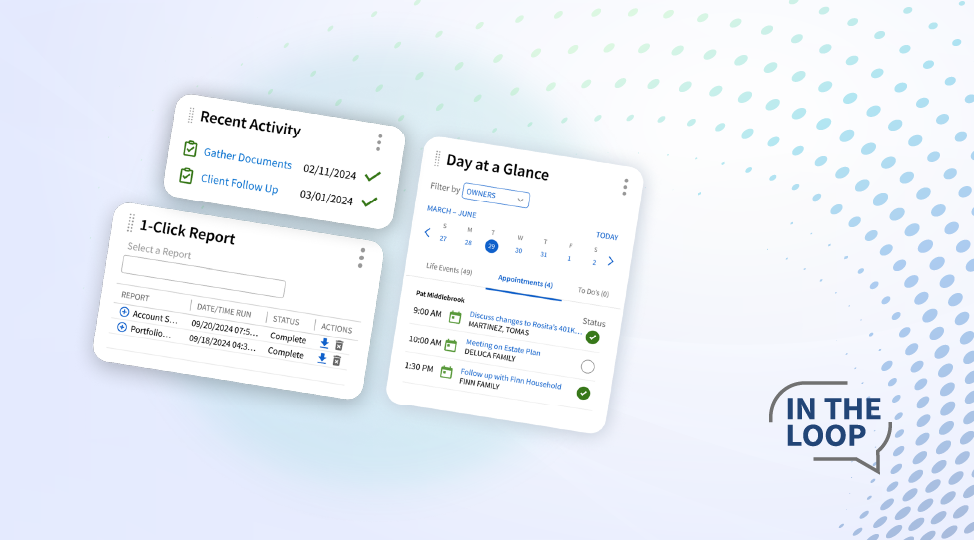

Picture this: You’re prepping for a client meeting—switching between several systems at once to locate client details, account balances, and...

According to our 2025 Connected Wealth Report, 85% of advisors believe generative AI will help their business—that’s up from 65% in 2024.