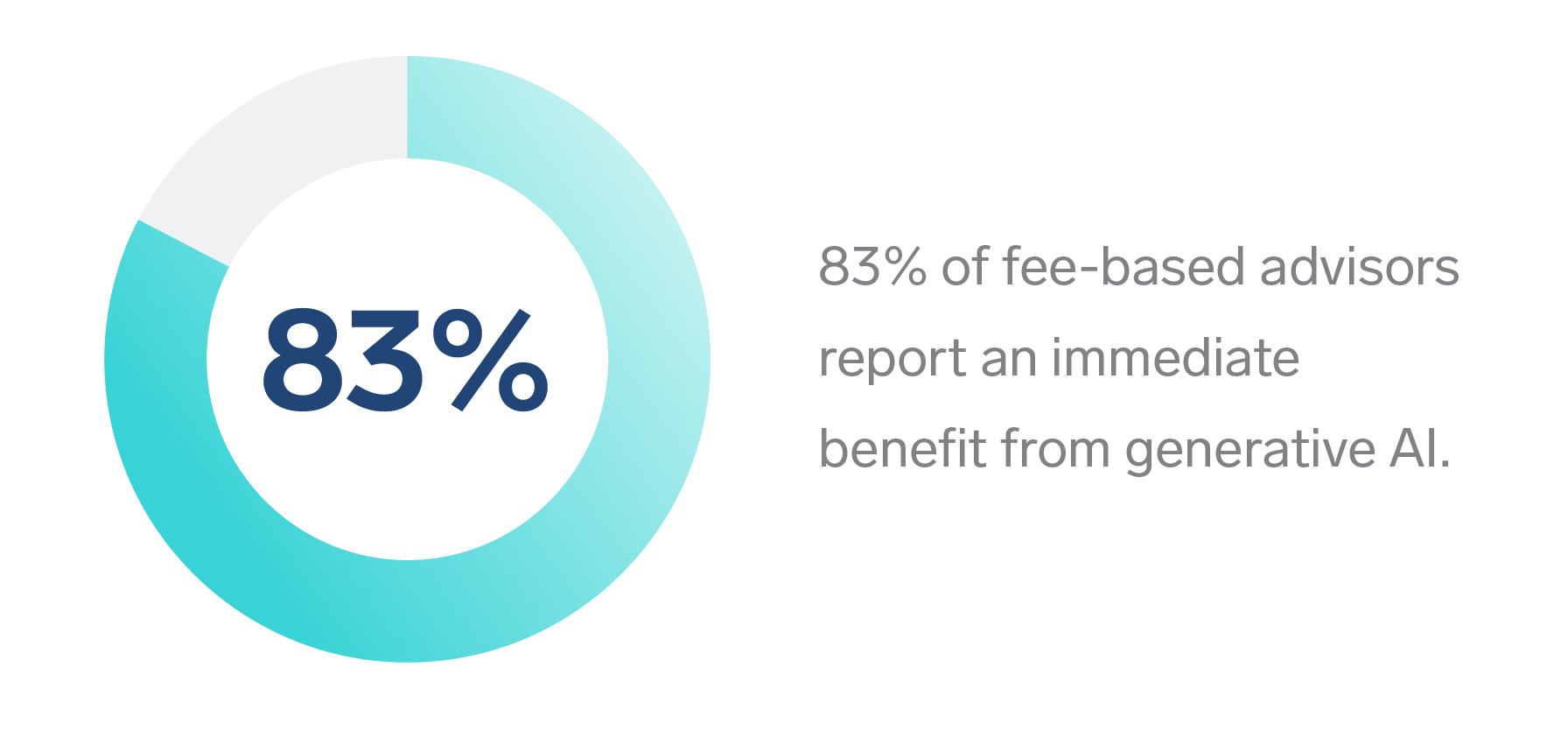

A major shift is underway. Generative AI and automation are being rapidly adopted across the RIA space—not as novelties, but as the new standard. Advisors are using AI to streamline meeting prep, automate compliance tasks, and reduce administrative burdens—freeing up time to focus on what matters most: client service and growth.”

Darren Tedesco | Advisor360˚ president

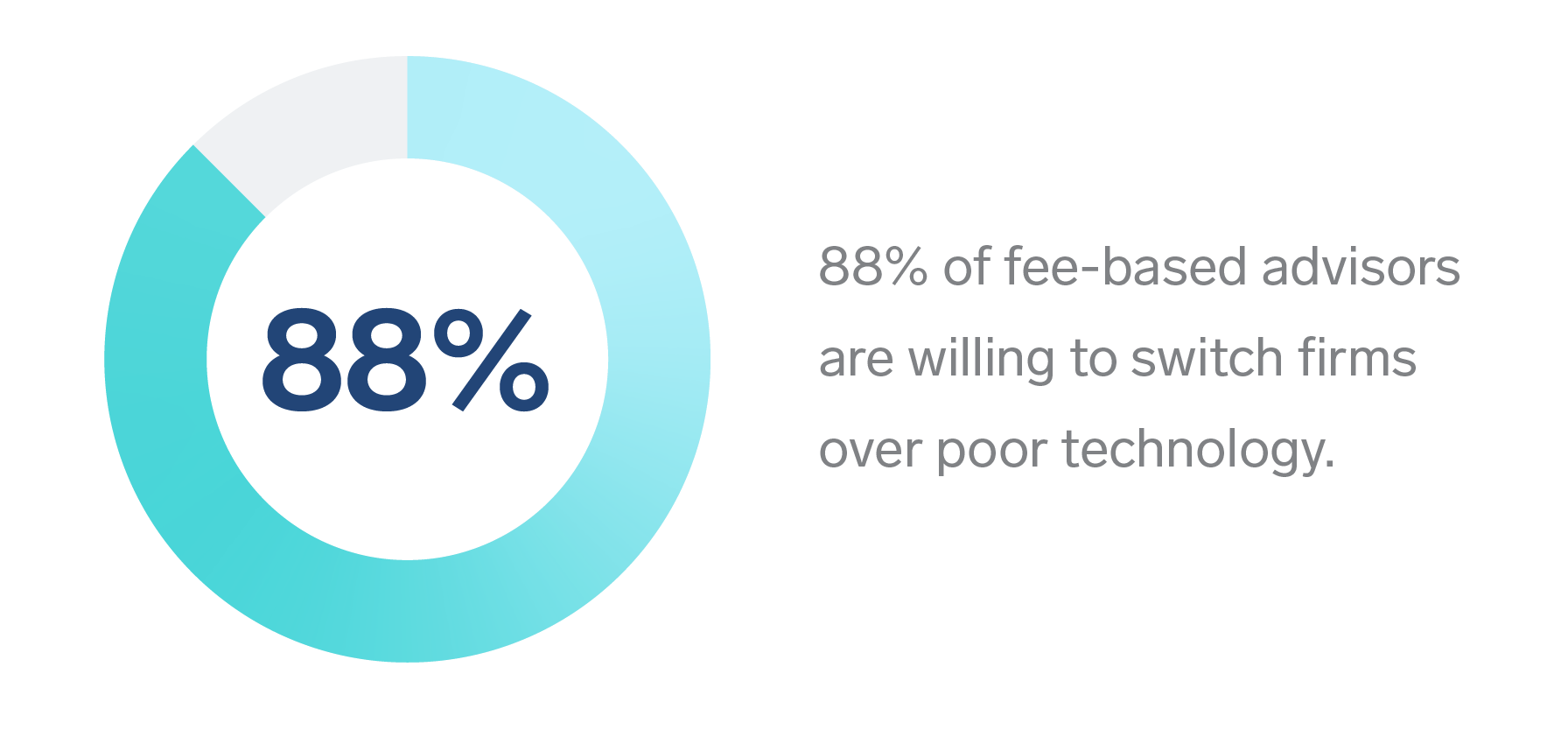

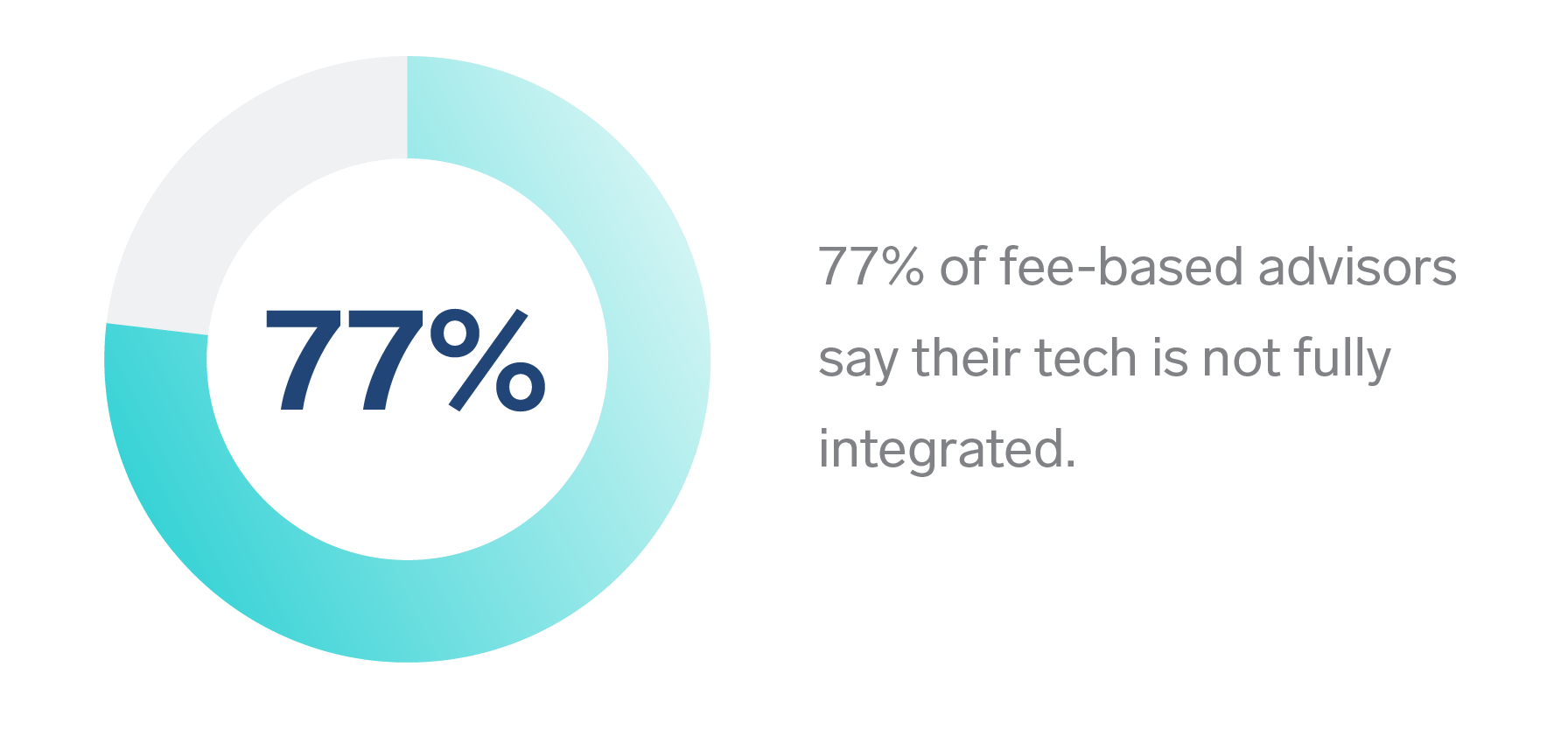

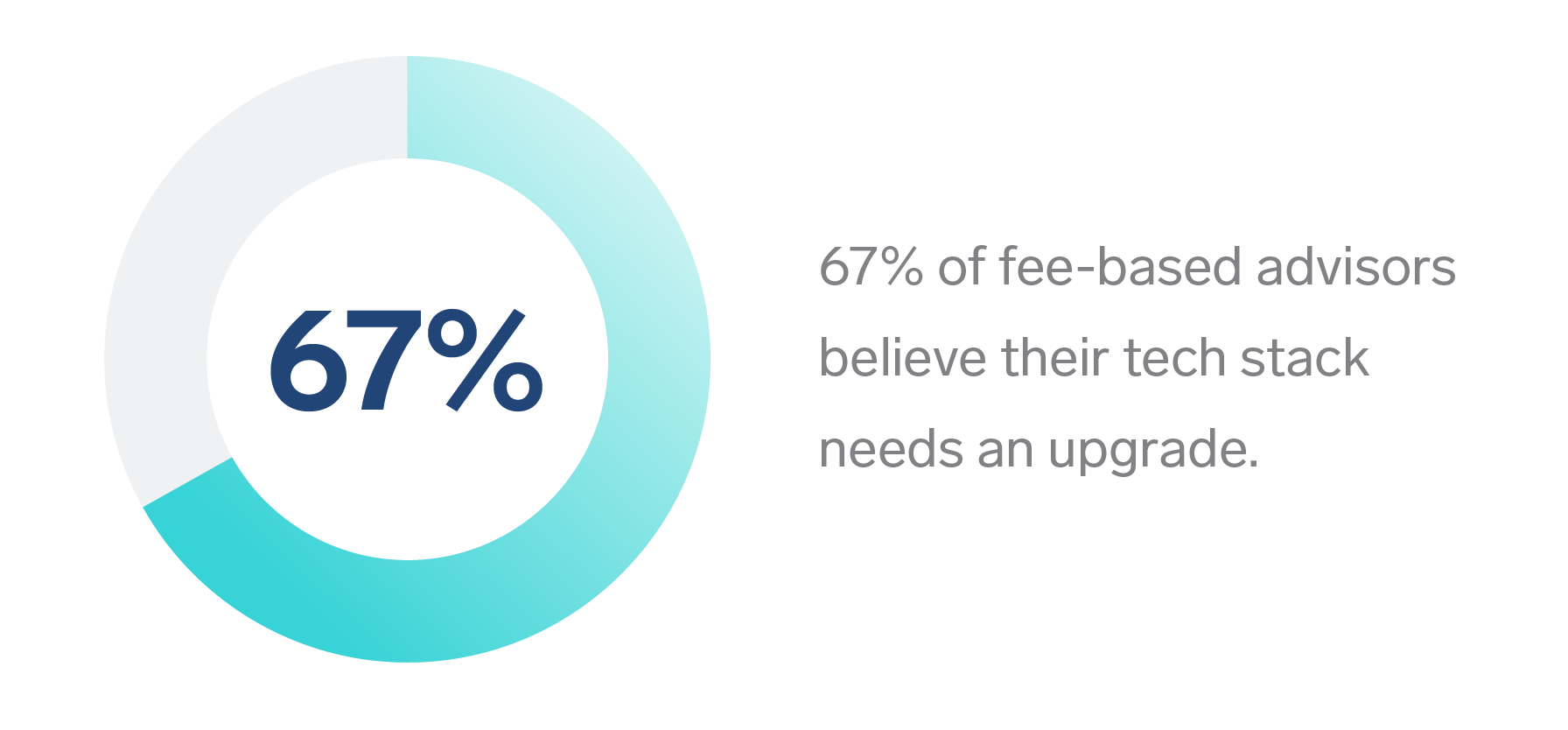

Independent Advisors Share Their Technology Issues

Bad data, lack of modern tools, and poor integration are major concerns.

Generative AI Is Transforming How RIAs Work

What Top Firms Are Doing Differently: Insights from the 2025 Connected Wealth Report

Uncover how smarter tech strategies are helping firms unlock advisor productivity, scale growth, and deliver standout client service.

- Save time and streamline advisor workflows

- Increase productivity and efficiency firmwide

- Meet rising client expectations with modern tech

About the research

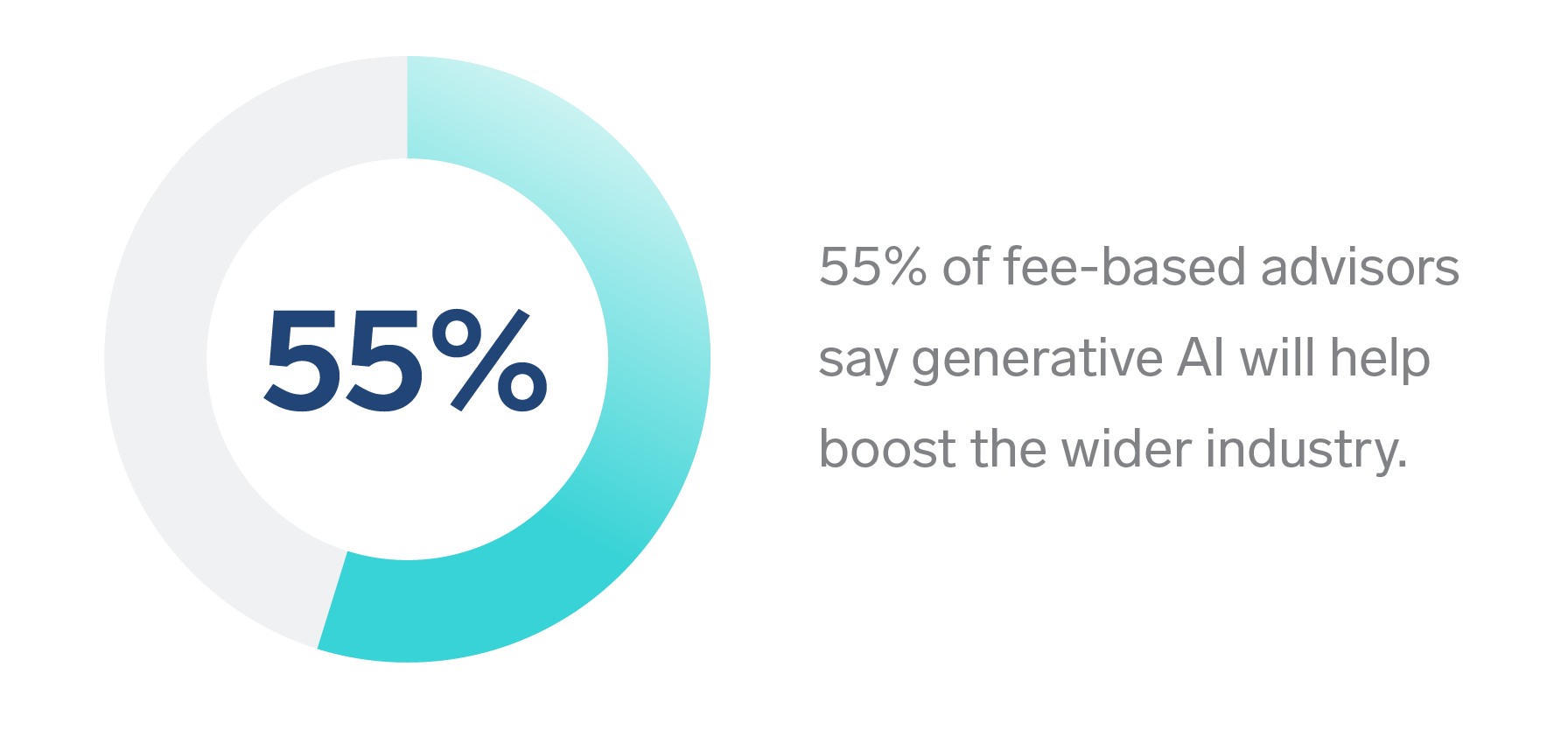

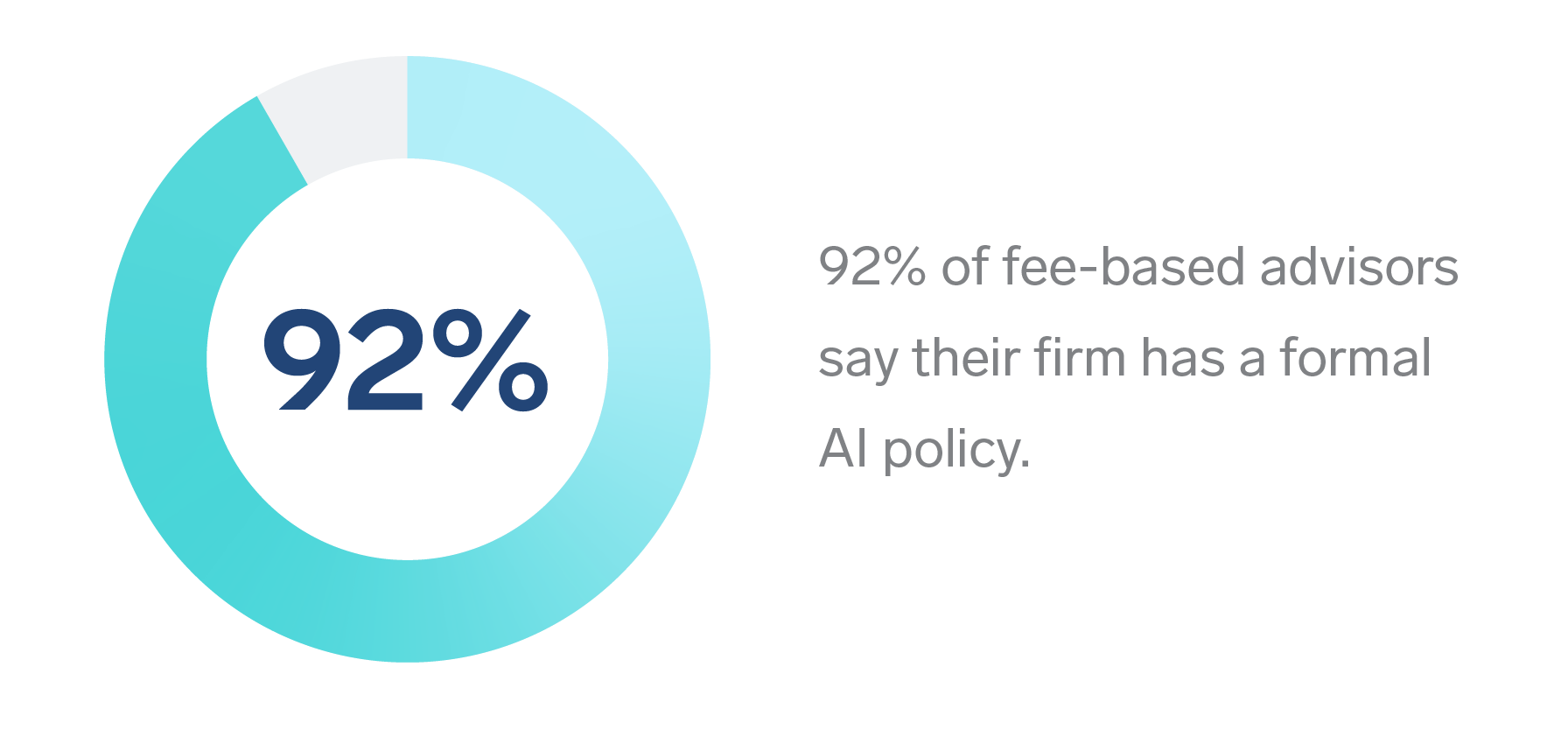

Advisor360° surveyed 75 fee-based advisors working at registered investment advisors (RIAs) in the U.S. to better understand how technology impacts the way they conduct business. Advisors self-identified as being part of a team that manages an average of $1 billion in assets and hailing from firms with an average AUM of $86 billion. Responses were collected via a larger telephone-and-email-based survey of 300 financial advisors fielded during September and October 2024.

About Coleman Parkes

Coleman Parkes is a full-service B2B market research agency specializing in IT/technology studies, targeting senior decision-makers in enterprises across multiple sectors globally. For more information: research@coleman-parkes.co.uk