Artificial intelligence and the next-gen advisor

With AI entering the mainstream, Advisor360˚ has surveyed 300 financial advisors for their perception of AI in wealth management.

Download the AI Connected Wealth Report

Jobs will shift over time based on advancements like AI, but new jobs will be created. I think of the job market as a pie that is not a fixed size; AI will help grow the pie, not shrink it. Based on the results of the survey, many advisors agree with that assessment.”

Darren Tedesco | Advisor360˚ president

Artificial intelligence: Helping or hurting financial advisors?

Do you consider the emergence of generative AI to be a help or a threat to your practice?

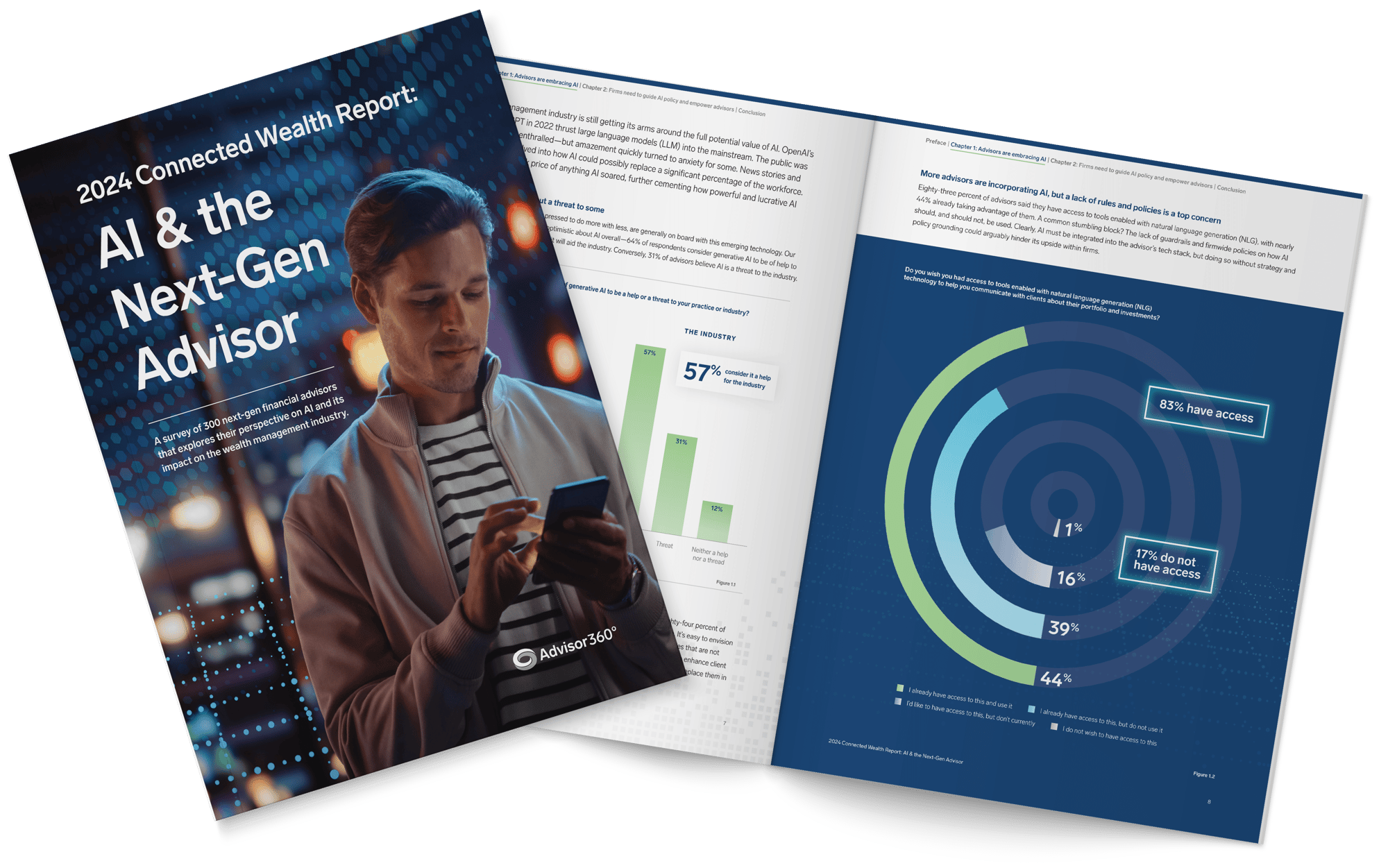

64% of advisors surveyed believe generative AI will assist their day-to-day workflows and client interaction.

Only 21% of advisors surveyed found generative AI a “threat” to their current practice.

15% of advisors surveyed felt it was neither an aid nor a hindrance.

What are the top three key challenges you face with your existing technology?

Sadly, 61% of advisors still say that bad data is the top challenge that they face.

However, 59% of advisors say a lack of automation and AI-enable capabilities is an issue.

57% of advisors say that a lack of end client capabilities is a problem they face.

Gain additional insight with the AI Connected Wealth Report

As market and client demands continue to evolve, advisors cannot afford to fall behind due to outdated or inefficient technology. The AI Connected Wealth Report highlights these concerns and answers:

- What percentage of financial firms currently have an AI strategy?

- What area of your business would benefit most from AI.

- If generative AI is viewed to be a long-term help or a threat to the industry.

About the research

Advisor360˚surveyed 300 mid-career financial advisors and executives at large broker-dealers, registered investment advisors and bank trust companies across the U.S. for their perspective on the impact of artificial intelligence (AI) on their current business. These questions were fielded as part of a larger survey on the role of technology in the financial advisors’s workday at large wealth management firms with an average of $9 billion in assets under managements and more than 1,000 employees. Respondents to the telephone to web-based survey, which was run during September and October 2023, were 36.5 years old on average with an average of $40 million under management.

About Coleman Parkes

Coleman Parkes is a full-service B2B market research agency specializing in IT/technology studies, targeting senior decision-makers in SMB to large and enterprises across multiple sectors globally. For more information, contact: research@coleman-parkes.co.uk