2026 Connected Wealth Report: AI Edition

Advisors and AI—A Matter of Trust

With AI playing a rapidly growing role in wealth management, Advisor360° surveyed 300 financial advisors to uncover how they’re leveraging it today to enhance client service and sharpen their competitive edge.

Download the Connected Wealth Report Now

We’re witnessing an era where AI is remaking wealth management through intelligence. Advisors who embrace this shift aren’t just keeping up with technology—they’re redefining how trust, transparency, and personalization come together in modern financial advice.”

Mat Mathews | Chief Product and Engineering Officer, Advisor360°

Advisors Are Embracing AI to Help Them Work Smarter, Not Harder

The next phase of AI adoption depends on building trust and confidence

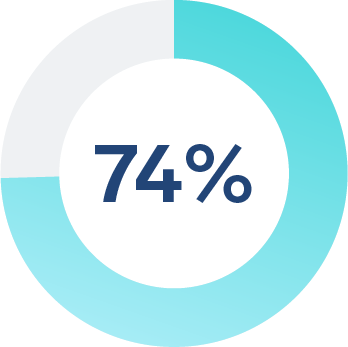

74% of advisors say AI will help their business

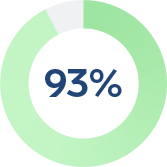

93% of advisors want final say over AI output

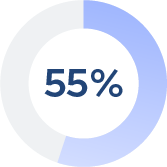

55% of advisors say compliance is the main hurdle to AI adoption

Learn more about:

- How advisors are using AI today—and what’s accelerating or slowing adoption

- Which areas of your business stand to gain the most from AI

- How advisors feel about AI and what they need to use it confidently

About the research

Advisor360° surveyed 300 financial advisors at registered investment advisors (RIAs), broker-dealers, and banks across the U.S. to better understand their perspectives on how artificial intelligence is shaping their work. Survey participants self-identified as being responsible for managing, on average, $548 million in client assets—either individually or as part of a team—and worked at firms with a median AUM of $65 billion. The email-based survey was fielded in Fall 2025 by FUSE Research Network on behalf of Advisor360°. Advisor360° and FUSE are separate and unaffiliated organizations.

Check out our past reports

2025 Connected Wealth Report

Special Edition

The #1 reason advisors switch firms is the desire for better technology.

2025 Connected Wealth Report

Technology Trends

74% of advisors say their tech is not fully integrated.

2025 Connected Wealth Report

AI Edition

44% of advisors use AI to predict client behavior.

2025 Connected Wealth Report

RIA Edition

88% of fee-based advisors are willing to switch firms over poor technology.