From Buzzwords to Business Impact: Insights From FSI OneVoice 2026

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

2 min read

Darren Tedesco

:

12/30/20 10:59 AM

Darren Tedesco

:

12/30/20 10:59 AM

2020 was a year unlike any other. And many of us are looking forward to turning the calendar page to 1/1/2021 and to a fresh start of a new year…one with vaccines on the way! In year-ends of past, I’ve often written reflections of the previous 12 months. This year, I’ve decided to take a different approach and let petabytes of data that we store at Advisor360° on our clients’ behalf tell the story of wealth management from a different lens.

With more than 400 direct data feeds being scrubbed daily, Advisor360°’s Unified Data Fabric™ (UDF) and comprehensive software platform allows us (and our clients) to look at data patterns (buzzword: analytics) and software usage across home office users, advisors, and clients in multiple software sleeves. We looked at the data 9 months prior to the major COVID outbreak (pre-March 2020) and the 9 months since. Here are the data trends we saw:

We have almost 200 reports available in our platform, some with billions of combinations. These were the most popular reports run in the Advisor360° platform over the last year:

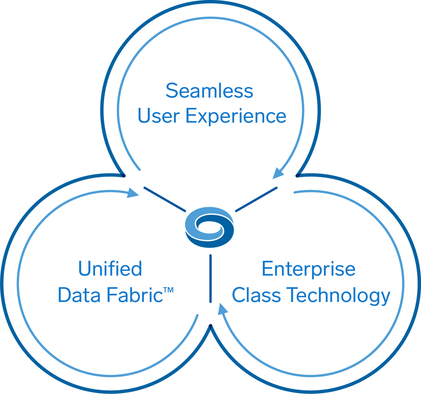

What enables our understanding of these data insights and software sleeves usage across 3 personas is our UDF. And the combination of that UDF, the seamless user experience, and enterprise-class technology is what allows wealth advisors and broker-dealers on our platform to be some of the most productive in the industry.

On behalf of all of us at Advisor360°, I wish you—and your data—a prosperous and safe journey in 2021!

Darren Tedesco is President of Advisor360° and has been part of our software development since its inception, bringing together the thinkers, creators, and visionaries that help power our clients’ productivity, profitability, and growth.

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

AI has already proven it can make advisors more efficient. The next phase of adoption will be defined by something equally important: trust.

The rationale for AI governance in fintech firms and how Advisor360°TM approaches roles, responsibilities, and enablement.