From Buzzwords to Business Impact: Insights From FSI OneVoice 2026

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

Advice360°™ is a series designed to help advisors increase their productivity using our digital wealth management software.

In this installment, Patrick Noonan, Advisor360°’s Product Manager for Wealth Management and Insurance, shows financial advisors how our new Dependent Workflows capability can save them time and enhance their clients’ experiences.

Regardless of how diverse a financial advisor’s book of business may be, many of the key tasks they perform for each client are actually very similar in nature, and the activities required to accomplish these tasks are almost identical. For this reason, workflows have become the backbone for any financial advisor seeking efficiency.

Advisor360° enables financial advisors to configure complex sequential activities into repeatable workflows that ensure every client receives a consistent and high-quality experience while minimizing the time it takes to provide this service.

What is more, Advisor360º workflows can be assigned to multiple back office employees who track what each other has done. This means they can complete the tasks without diminishing the quality or consistency of service or share the tasks with the entire office to establish best practices when dealing with clients’ particular circumstances.

Our new Dependent Workflows capability allows advisors to be more detailed in the steps they take in unique business processes because we understand that certain steps can't happen before others—there are dependencies.

Workflows not only keep advisors organized, they make advisors more efficient. We can scale and track repeatable processes, such as:

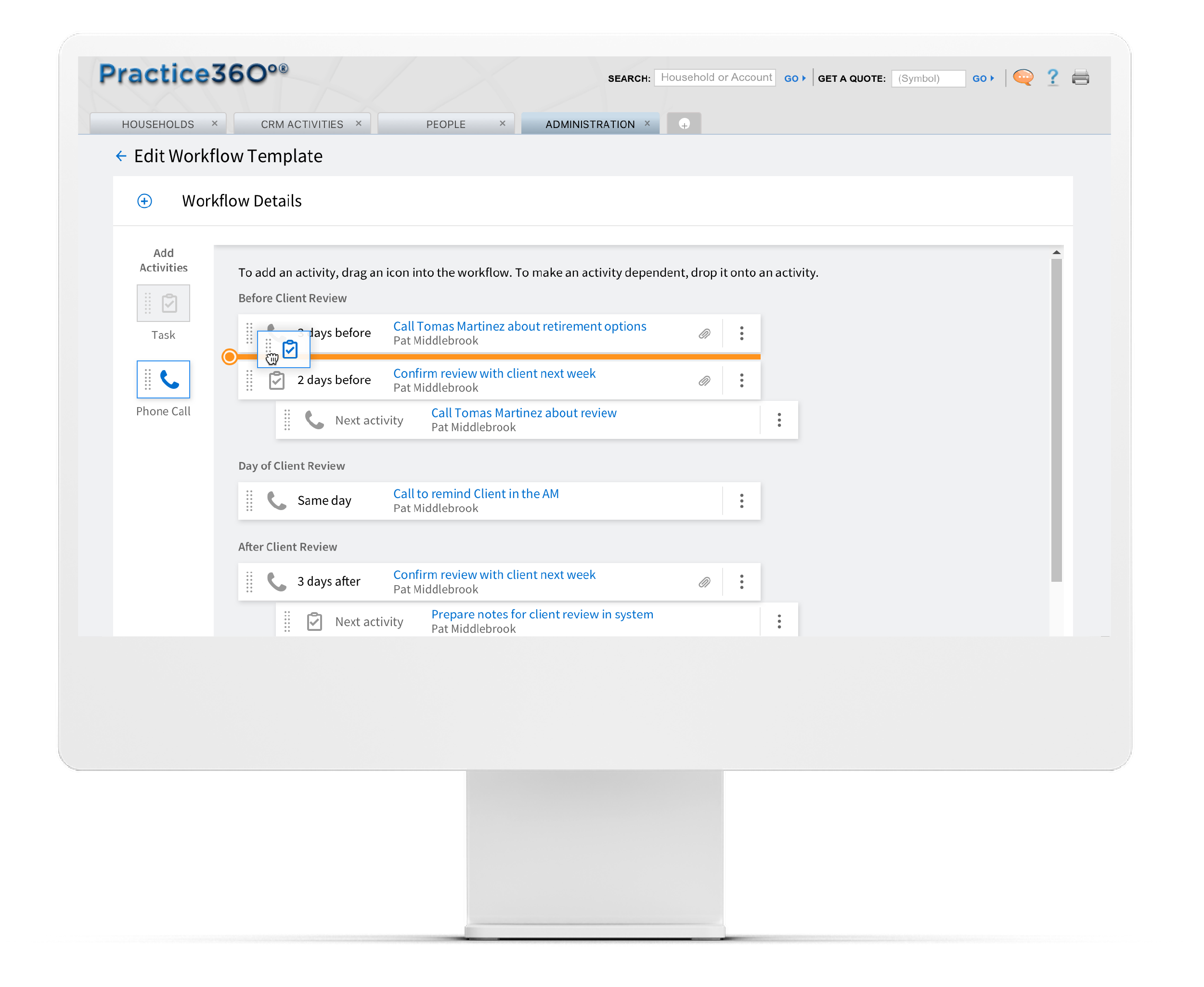

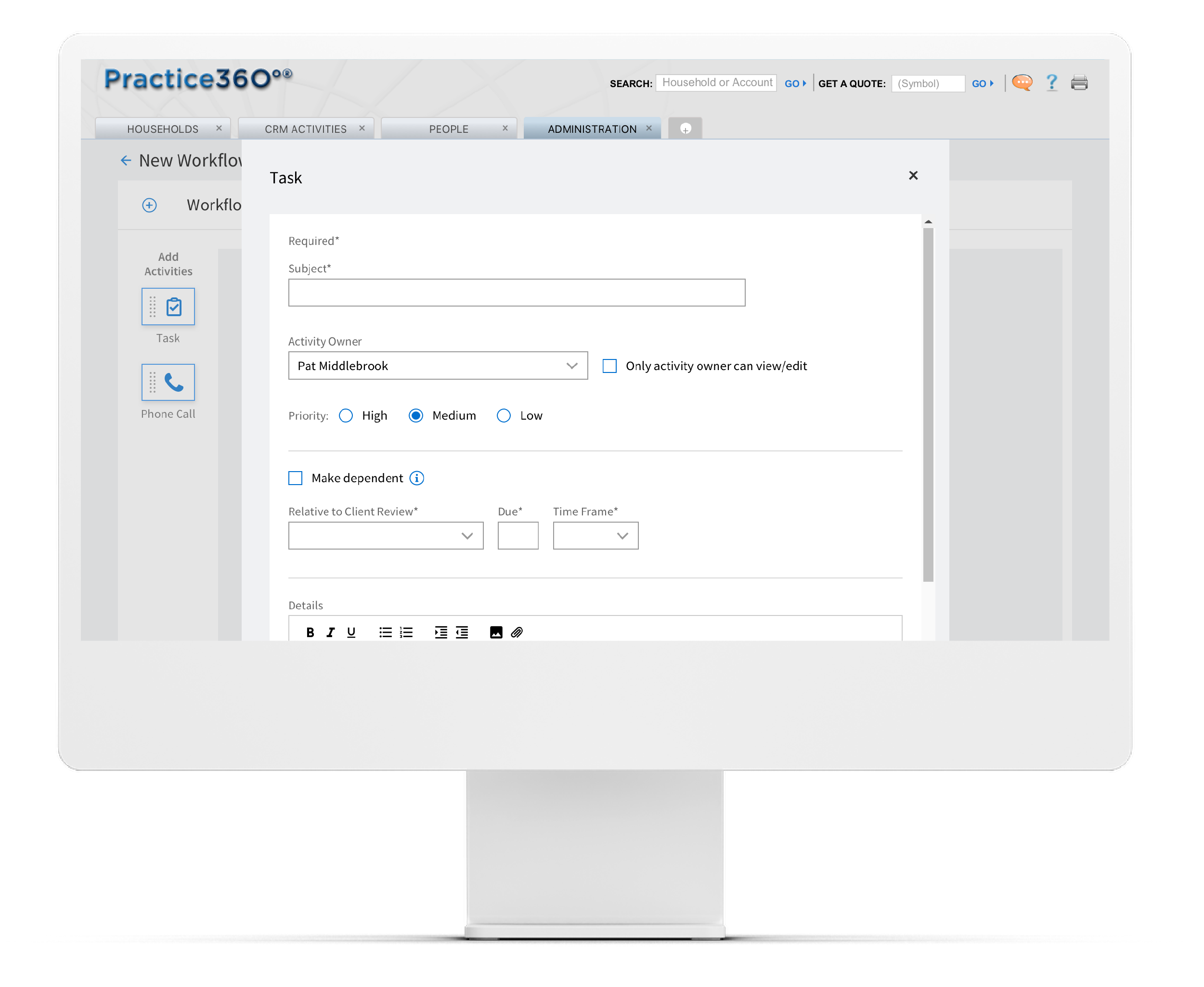

Drag-and-drop activites

Use our drag-and-drop functionality to quickly add CRM activities to a workflow template. Simply grab an activity icon and drop it before, after, or the day of a main event. Once an activity icon has been selected and dragged over, enter all necessary details in the activity pop-up.

Dependent activities

Advisors can also drag an activity icon onto an existing activity, which will create a dependent relationship. This allows for a sequence of activities, ensuring that certain items are not started until a previous one has been completed. Drag and drop a parent activity into the new location if adjustments are needed. All child activities will follow the parent.

Applying a workflow

To apply a workflow, simply:

Once a workflow is applied, it can be monitored in our practice-level reporting feature, allowing users to view and filter all open activities and make targeted edits if necessary.

By utilizing our new Dependent Workflows capability, advisors can configure complex sequential activities into repeatable tasks, increase efficiency, and provide their clients consistency. While our insurance and wealth management capabilities are already the most sophisticated on the market, we plan to offer more features later in 2022 to further streamline processes for broker-dealers, advisors, and their clients.

Advice360° offers tips and guidance to advisors on increasing their productivity through the Advisor360° wealth management software. Learn what other wealth advisors are doing to benefit their practice.

Patrick Noonan is Product Manager for Wealth Management and Insurance. Backed by his years of experience as a Certified Financial Planner (CFP®), Patrick defines and oversees product features that improve broker-dealer, advisor, and investor performance and efficiencies in the banking, investment, and insurance industries.

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

AI has already proven it can make advisors more efficient. The next phase of adoption will be defined by something equally important: trust.

The rationale for AI governance in fintech firms and how Advisor360°TM approaches roles, responsibilities, and enablement.