From Buzzwords to Business Impact: Insights From FSI OneVoice 2026

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

5 min read

David Townsend, Halo Investing

:

8/29/23 10:10 AM

David Townsend, Halo Investing

:

8/29/23 10:10 AM

The Advisor360° Amplify program brings industry leaders together to share their expertise with the wealth management community. In this blog, Dr. David Townsend of Halo Investing discusses how offering the right selection of investment products is crucial for retaining clients.

Today’s discerning wealth management clients seek portfolios that can withstand protracted market volatility while delivering upside returns from equities and a stable income stream from fixed-income solutions. The current investing environment lends itself to a broader range of possible portfolio products to meet those demands. Consider that bond market yields, at long last, sport inflation-adjusted positive returns while some slices of the global stock market are priced reasonably for clients who have extended time horizons.

All that makes the advisor’s job challenging. It’s as if there are too many possible choices today. This, of course, comes after a multi-year period of Fed-induced rock-bottom interest rates, resulting in paltry bond yields that simply did not deliver a commensurate return for the amount of duration risk taken on. That assertion played out from late 2020 through Q4 of 2022. Real total returns for an aggregate bond market index fund were not just bad, but they caused financial stress on retirees and those approaching retirement.

Today, offering the right selection of investments to build a lasting book of business and retain clients might seem like a time-intensive task, one that is heavy on numbers crunching and efficient frontier analysis. Sure, you can’t discount the importance of that side of due diligence, but financial planners also realize that often the best portfolio is usually the one an ordinary investor can stick with during the despondency of bear markets and the euphoria that comes about during raging bull markets. Both situations can be perilous for people without a stalwart set of stocks, bonds, and other asset classes and vehicles.

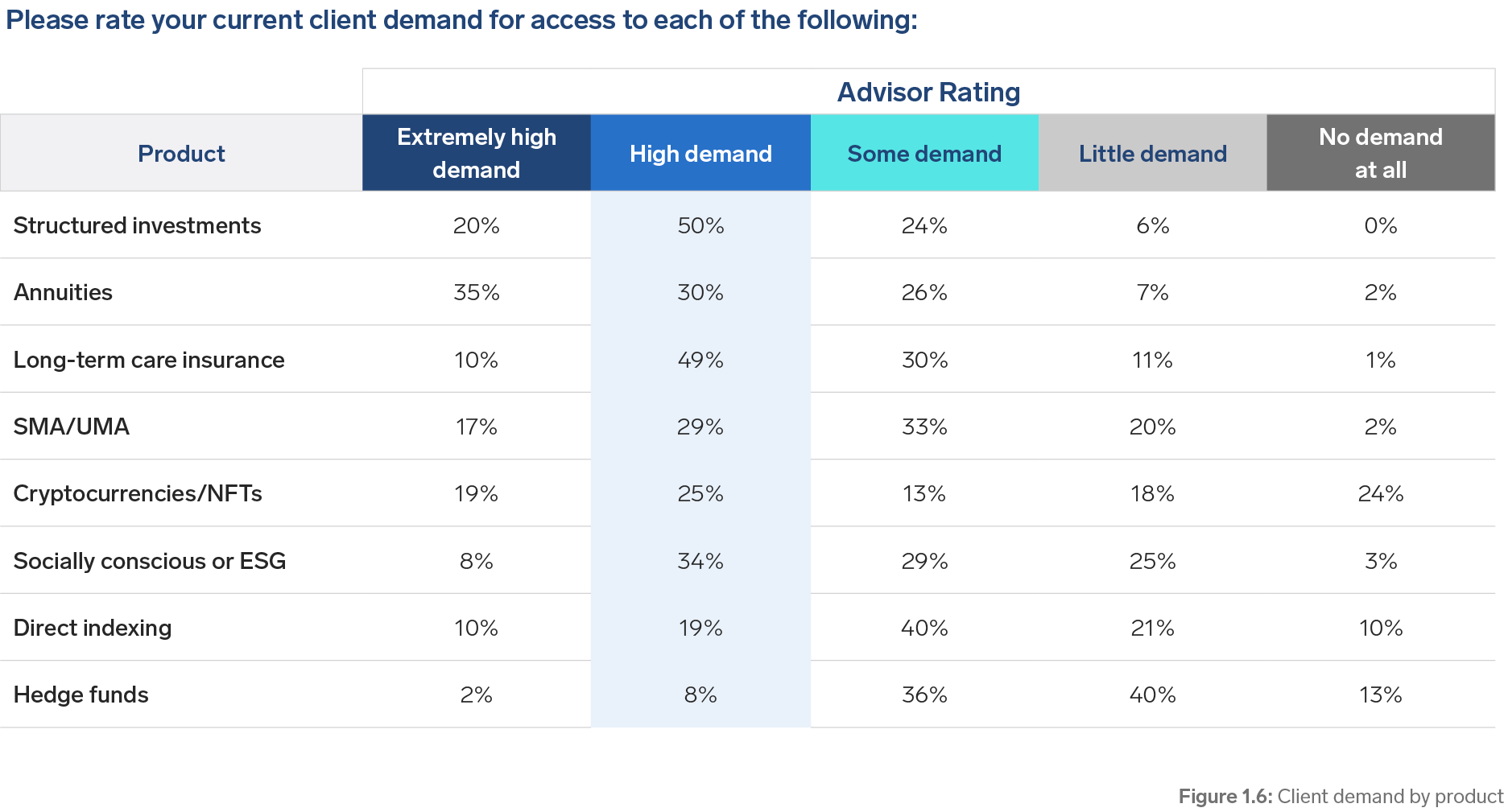

The Advisor360° 2022 Connected Wealth Report sheds light on a theme that is backed up by numbers: Client demand for differentiated investment solutions is on the rise. According to the survey’s findings, and the 300 advisors polled, personalized and goals-based strategies are in demand. In fact, once obscure and high-cost structured investments are now top of the list in terms of what clients are asking for. Seventy percent of advisors (including executives from a range of broker-dealers, RIAs, and bank trust companies) report robust interest from their customers for the structured product vehicle as a portfolio option.

Source: Advisor360° Connected Wealth Report 2022

Structured notes are more appealing than ever today given the great lengths technology has gone to bring down transaction costs. Also, more competition helps to provide greater transparency with respect to the fee structure of these once-opaque products. What had once been a thriving note market confined mainly to Europe and Asia, North American advisors are now able to harness the practicality and behavioral benefits of notes.

Some of notes’ benefits include the potential for equity-like returns with lower volatility, defined risk management strategies, and high yields with enhanced upside participation. It sounds all too good, but the beauty of structured products lies in their simplicity. A note is merely a long bond position paired with an options package; it’s a framework advisors can easily wrap their minds around and can explain to clients.

Structured notes are not the only increasingly popular investment choice in today’s landscape. The Advisor360° data highlights that annuities are back on the rise. After the survey was conducted in September of 2022, LIMRA reported a record annuity transaction volume for the full year. Total sales jumped to $310.6 billion in 2022, a 22 percent increase from the previous year’s results and 17 percent higher than the record set in 2008, according to preliminary results from LIMRA’s U.S. Individual Annuity Sales Survey.1 Perhaps even more impressive, a quarterly record was shattered in Q1 of 2023 with annuity transaction volume spiking to $92.9 billion, a massive 47 percent surge from the same period a year earlier.2

You might notice a theme here: protection is paramount. Advisors that can cater to people’s natural inclination to mitigate risk stand to benefit – even in a period of strong stock market returns. Loss aversion runs deep in the human psyche, so there’s behavioral alpha when a wealth manager can craft portfolios so that the downside is both known with a high degree of certainty and is limited in nature. That concept lends itself to insurance. It turns out that, per the Advisor360° survey, there remains significant demand for long-term care insurance.

According to data gathered by the U.S. Department of Health and Human Services, nearly 70 percent of individuals turning 65 today are expected to require some form of long-term care in their lifetime.3 If you’re an advisor working with a mass-affluent couple in their 60s, there is an extremely high chance that at least one spouse will need costly long-term care.

There are generally two options: (1) self-insure through savings and investments, keeping an exceptionally large bucket of low-risk money at hand should the need arise sooner rather than later, and (2) purchase a long-term care insurance policy. The latter option is expensive – wealth advisors understand this full well. It takes a thoughtful, risk-centered analysis of someone’s situation to determine what the right move is – and that goes beyond just the numbers on a spreadsheet. Offering a competitive long-term care insurance coverage option for individuals and couples in their 50s and 60s can truly round out an advisor's product suite to better meet all needs and cover as many risks as possible.

Getting back to the traditional stock and bond markets, as you can see in the above graphic, separately managed accounts (SMAs) and unified managed accounts (UMAs) have snuck up as in-demand products to help advisors retain clients. You see, during the great bond bear market from August 2020 through October 2022, the risks of owning a plain vanilla aggregate fixed-income mutual fund or ETF were seen. The longer the fund’s duration, the more rising interest rates stung in terms of NAV downside.

So, many advisors chose to ditch the index funds and go with a separately managed account that could house a few individual Treasury securities or corporate credits. That way, all a client had to do was hold the investments to maturity to avoid capital losses. Of course, financial professionals recognize that a few individual bonds and a bond fund are the same thing in essence, but there’s behavioral upside to having an SMA or UMA in your product lineup (though these managed accounts are more like the investment house, and not a specific investment themselves).

Finally, there are ebbs and flows with other investment types. Cryptocurrency had its day in the sun during the “ZIRP” Fed era, while the environmental, social, and governance (ESG) movement seems to come and go in popularity. It remains to be seen, however, whether these niches can truly garner enough demand to make them worthwhile for today’s busy advisor to expand their business effectively and efficiently. Bitcoin and the like dropped in value from their boom-period peaks while ESG came under intense political scrutiny during 2023 (not to mention investing experts questioning how much alpha such strategies truly provide considering their often relatively higher costs).

We’ll be keeping our eye on trends in direct indexing. Like with structured products, technology and competition have brought about much lower industry costs to implement a tailored direct indexing strategy. We might still be in the early innings on how it will unfold, but for now, advisors do not hear too great of client demand for that portfolio construction and management method.

The same goes for hedge funds which are increasingly seen as costly and unreliable alpha sources. Gone are the days from, say, 10 or 15 years ago when so many hedge fund rockstars sported massive returns during a prolonged period of lousy S&P 500 performance. Could that era come back? Of course, anything is possible, but other investment products are clearly ranked higher in terms of what is being asked about at the retail level.

Offering the right selection of investment products and asset vehicles is crucial for retaining clients in today’s changing wealth management environment. Everyday investors demand portfolios can weather market storms and participate in bull market rallies. What’s more, the data underscore the importance of risk management solutions.

Structured notes, long-term care, and SMAs can all generate behavioral alpha for an advisor, making client retention much easier. It’s all about personalized and goals-based strategies. Understanding and providing the right mix of investment options tailored to clients' needs and risk tolerance can significantly enhance client retention and satisfaction.

Dr. David Townsend, DBA, CFA, leads product marketing and thought leadership at Halo Investing. He’s responsible for helping advisors develop and articulate how portfolios can benefit from defined-outcomes and other alternative strategies.

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

AI has already proven it can make advisors more efficient. The next phase of adoption will be defined by something equally important: trust.

The rationale for AI governance in fintech firms and how Advisor360°TM approaches roles, responsibilities, and enablement.