RIA 2.0: Less Paperwork, More Personal Connections

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

Legacy technology foundations are making your AI slow, unreliable, and less effective. Learn how to move from tactical to transformational.

Here’s something you already know: artificial intelligence (AI) is reshaping wealth management. For advisory firms, it promises to unlock new levels of productivity, deliver hyper-personalized advice, and free advisors to spend more time where it matters mostAdvisor360° shows how AI in wealth management succeeds with strong data foundations—turning insights into action across every client relationship with clients.

But there’s a hard truth you may not know: AI is only as good as the data and systems beneath it.

Before an advisor can trust an AI assistant to surface insights, summarize meetings, or recommend next best actions, that AI must be fed by unified, normalized, and secure data. If the foundation beneath the technology is shaky, the AI’s output will be unreliable—no matter how sophisticated the model on top.

In wealth management, every insight is connected to a client’s broader financial story. Their retirement goal is linked to their portfolio, which is tied to a business sale, which is linked to an estate plan and multiple custodians. When data lives in silos—as it so often does—AI can’t connect the dots and make sense of it.

Reliable, transformational AI insights start with integrated data that mirrors how advisors actually work—across households, accounts, and generations. Without that, AI can tell you what’s happening in one corner of a client’s financial life but not how it impacts and connects to the others.

Many firms still use legacy systems and old architecture that weren’t built for the present age of AI. Let’s look at four failure points that hold AI back—and how to fix each one.

At most firms, advisors are dealing with a dozen separate logins: one for the CRM, one for their planning tool, one for performance reporting, another for compliance. Each holds a slice of the client’s story—but never the whole narrative.

When AI can only access isolated pieces of information, it can’t deliver holistic insight. It might know a client’s 401(k) balance but not that they recently opened a trust for their grandchildren. Or it may flag a drop in an account without realizing that cash was intentionally moved to fund a college savings plan.

The fix: Bring all client data together into a single, connected view. A unified data layer consolidates and maps information across platforms—giving AI the context it needs to understand why things are happening, not just what is happening.

Even when firms manage to gather data from multiple systems, the information often doesn’t line up. One custodian labels an account as “retirement,” another calls it “qualified.” One CRM tracks households, another only individuals. Sometimes even names are different across accounts—Jake versus Jacob.

For AI, these inconsistencies are like mismatched puzzle pieces. The result? Advisors get inaccurate summaries (e.g., double-counted linked accounts, inconsistent net worth totals) or misclassified transactions (e.g., 529 contributions tagged as brokerage deposits, Roth rollovers labeled as traditional IRAs).

The fix: Start by normalizing data at the source. Define a canonical data model, map custodial and CRM fields to it, apply householding and entity-resolution rules, enforce controlled vocabularies (like account types), and validate with automated quality checks before exposing data to AI. With that foundation, AI can distinguish a Roth from a rollover and a household from a single client—without human correction.

AI’s power lies in its ability to connect information, but that connection must be carefully managed. Without proper permissioning, an AI could surface a sensitive note from one client meeting as part of generating insights for another—or reveal data that should remain private.

Advisors work in a world built on trust. If a client believes their information might be exposed, the technology meant to deepen relationships can erode them instead.

The fix: Protect trust by controlling access to sensitive data. Implement AI-ready safeguards such as unified identity (SSO), least-privilege roles, data-scoped permissions, and auditable consent. With those in place, AI gains the context it needs—without ever seeing what it shouldn’t.

Many legacy systems were built to store information, not respond to it. Their APIs allow users to pull data, but not to trigger workflows or push updates in real time.

That’s why most advisor-facing AI today feels reactive—it tells you what happened, but not what to do next.

Imagine, instead, AI that can notice a client’s liquidity event and automatically create a task to review their investment mix—or alert the advisor that a beneficiary update is overdue. That requires systems built for orchestration, not just reporting.

The fix: Modernize your APIs and adopt event-driven architecture so AI can do more than observe—it can act. With the right orchestration layer, AI can automate tasks, surface opportunities, and proactively drive client engagement.

As these barriers are addressed, firms will unlock AI that is accurate, explainable, and useful. Advisors will gain insights they can trust—patterns that reveal client needs, proactive alerts when something changes, and next best actions that drive measurable outcomes.

That’s where the real transformation happens.

At Advisor360°, our unified data layer provides that foundation. It connects data across the CRM, planning, portfolio, and reporting systems that power advisory firms—creating a single, normalized, and permissioned data layer. That’s what enables Parrot AI® and every Advisor360° application to deliver insights that are fast, useful, and trustworthy.

AI is already changing wealth management—but the firms that will lead are those that invest first in their foundation. Because in AI, as in architecture, what’s built on solid ground lasts.

Paul Morville is Co-Founder of Parrot AI and Product Architect at Advisor360°.

Have you tried our AI teammate–Parrot AI? Click here to start your free trial or book a demo. Parrot is also available as part of Advisor360°’s comprehensive enterprise wealthtech platform.

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

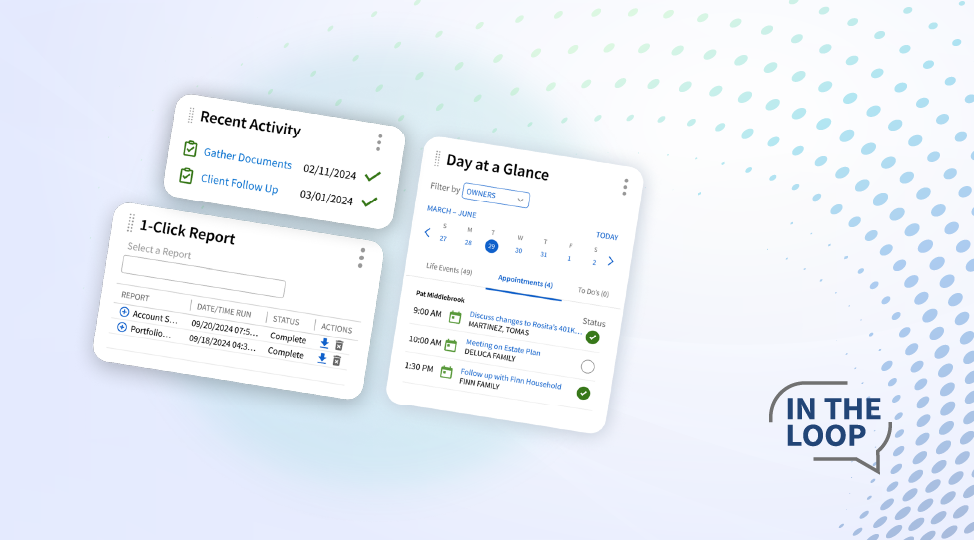

Picture this: You’re prepping for a client meeting—switching between several systems at once to locate client details, account balances, and...

According to our 2025 Connected Wealth Report, 85% of advisors believe generative AI will help their business—that’s up from 65% in 2024.