From Buzzwords to Business Impact: Insights From FSI OneVoice 2026

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

4 min read

David Townsend, Halo Investing

:

7/17/23 2:29 PM

David Townsend, Halo Investing

:

7/17/23 2:29 PM

The Advisor360° Amplify program brings industry leaders together to share their expertise with the wealth management community. In this blog, Dr. David Townsend, CFA, of Halo Investing discusses how technology improves the advisor-client relationship.

Does it feel like tech disruptions are hitting left and right? After a tumultuous year of stock and bond market returns in 2022, the last several months have brought about new challenges. Advisors can view emerging technological solutions, including artificial intelligence, as productivity boosters rather than risks and drivers of stress. Though, for some old-school wealth managers, the latest chic tech platforms may feel like a distant thing, but ignoring what’s happening up and down the best tech stacks is a perilous error of omission.

Having the best tools allows advisors to save time, and building current relationships and developing new ones is at the heart of the advisory business. Those hours saved lay the foundation for crafting better planning strategies and offering recommendations better suited to an individual’s unique money needs.

The 2022 Connected Wealth Report explores the role wealth management firms’ technology plays in facilitating business. The survey of 300 financial advisors and executives across a range of large broker-dealers, RIAs, and bank trust companies aims to cut out the noise so advisors can focus on spotting the true factors determining long-lasting engagement with clients.

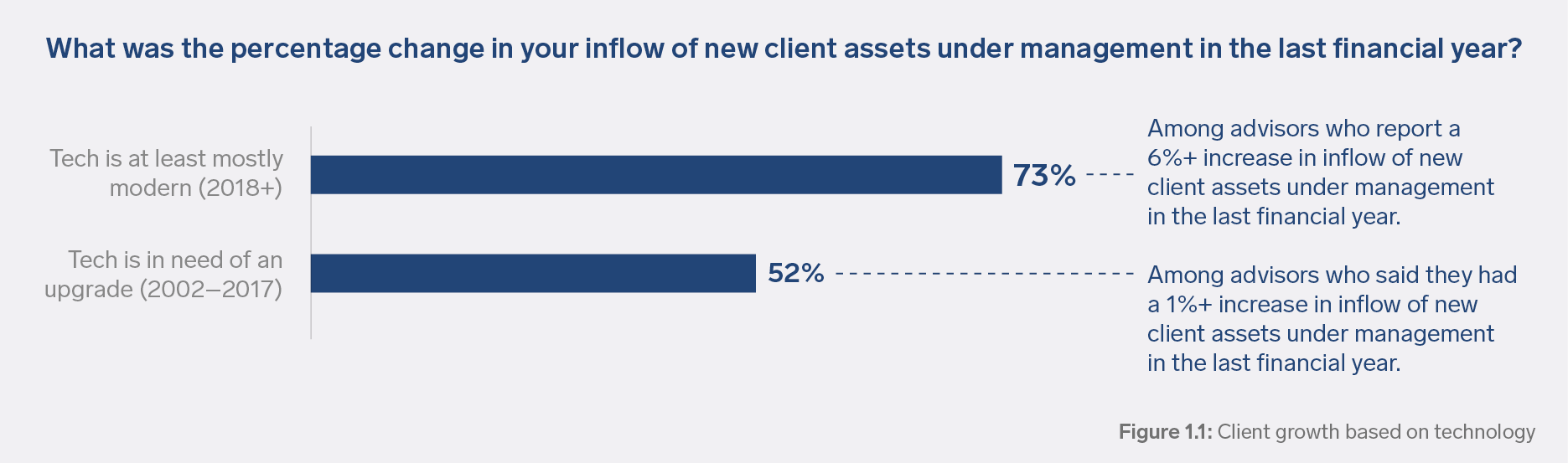

Let’s start by analyzing new relationships. Advisors’ voices were heard loudly in this regard. Technology indeed plays a crucial role in establishing not just competence, but also assurance that the advisor knows their craft and can use their skills to construct practical financial plans. Seventy-three percent of advisors who enjoyed a 6%-plus increase in new client assets under management inflow in the last financial year feel their tech ecosystem is mostly modern. Contrast that with a majority of advisors, 52%, who admit to having a dated digital infrastructure reporting just a 1%-plus annual AUM jump.

Source: Advisor360° 2022 Connected Wealth Report

People today expect a financial advisor to command more than just a rudimentary understanding of what makes for a user-friendly website, portal, and overall experience. If you lack basic services, such as a streamlined CRM platform, robust financial planning software, portfolio management reports, data aggregation solutions, and security controls, you are behind the eight ball when it comes to attracting new clients.

As we detailed in our previous article, many wealth management firms are in dire need of a tech refresh. Indeed, investing in the right tools leads to more referrals as your new clients get onboarded and become satisfied, even impressed, with the value they receive. Before long, the recommendation train will chug along. The bottom line here is that you need more time on your calendar to have those scheduled and impromptu deep conversations with families to get the positive word-of-mouth ball rolling.

Salient discussions around saving for a child’s future, empathy regarding inheritance situations, and optimistic projections for a future home purchase can only be had when the grunt work is efficiently performed. Even a trite asset transfer talk can retain business when an antsy client hears a pitch for a flash-in-the-pan strategy detailed in some seminar event.

Few other industries are built as much on relationships as the financial advisory arena. We all know that a high-net-worth couple or someone in the mass affluent bunch rarely performs a Google search to hire a financial planner. Rather, they are wont to choose someone they can trust. Instead of typing in a search engine, they tap the shoulder of a friend at a fitness class or someone they know well through church. Seeking direction in confidence from an individual they know well is the first action in the sequence that ultimately leads to an enduring advisor-client partnership.

Getting back to the Connected Wealth Report, data show that advisors obtain new business via referrals, but those with modern technology capabilities were 33% more likely to say their clients recommend them to others. Respondents assess the strength of their client connections on a host of factors, with helping their customers achieve their goals chief among them. Also critical in the eyes of advisors is the length of time someone has been a client and simply the household’s account size.

Source: Advisor360° 2022 Connected Wealth Report

However, there might be more going on. Deeper, more personalized services are demanded by today’s busy professionals who work nonstop and wish to retire one day while giving their children every possible advantage. Financial software can turn those obscure goals into a real-life values-based action plan.

Step by step, you can visually demonstrate to a couple how one approach versus another can get them to where they want to go. It’s through that mutual understanding that confidence thrives. At the same time, the clients get what they desire—more savviness with their money. The optimal tech stack turns a complex financial plan that makes a loud thud when dropped on a table into a cohesive visionary rubric.

Among current clients, many of the same themes echo, but there is a slight tone shift. A tech framework that can communicate across channels is critical to deepening relationships. More than three-quarters (76%) of respondents say that secure texting, or similar direct messaging, has dramatically impacted the way they work with clients or could impact the way they work with them in the future. Brushing off simple and even automated communication mediums not only threatens your client relationships but likely also costs you time. Think about how all the calendar products and social media add-ons could save you just, say, 15 minutes a day in follow-ups. The hours add up and can then be spent on other meaningful engagement efforts.

And the next generation will appreciate you as the advisor if you possess a good ‘gram game, snazzy Snap skills, and can TikTok with the best of them. Now, that sentence probably garnered an eye roll from most readers. In all seriousness, the data does not lie. Seventy-three percent of those surveyed said that indeed millennials and Gen Z require different touch point types than seniors, baby boomers, and Gen X. Part of promoting better ongoing collaboration among younger clients is to engage them differently.

Let’s bring it home with a focus not just on better client connections, but on how time can be saved. The report highlights four primary tools used regularly by wealth managers that are in need of an overhaul. Account aggregation (58%) and digital marketing tools (55%) are seen as the biggest sore spots.

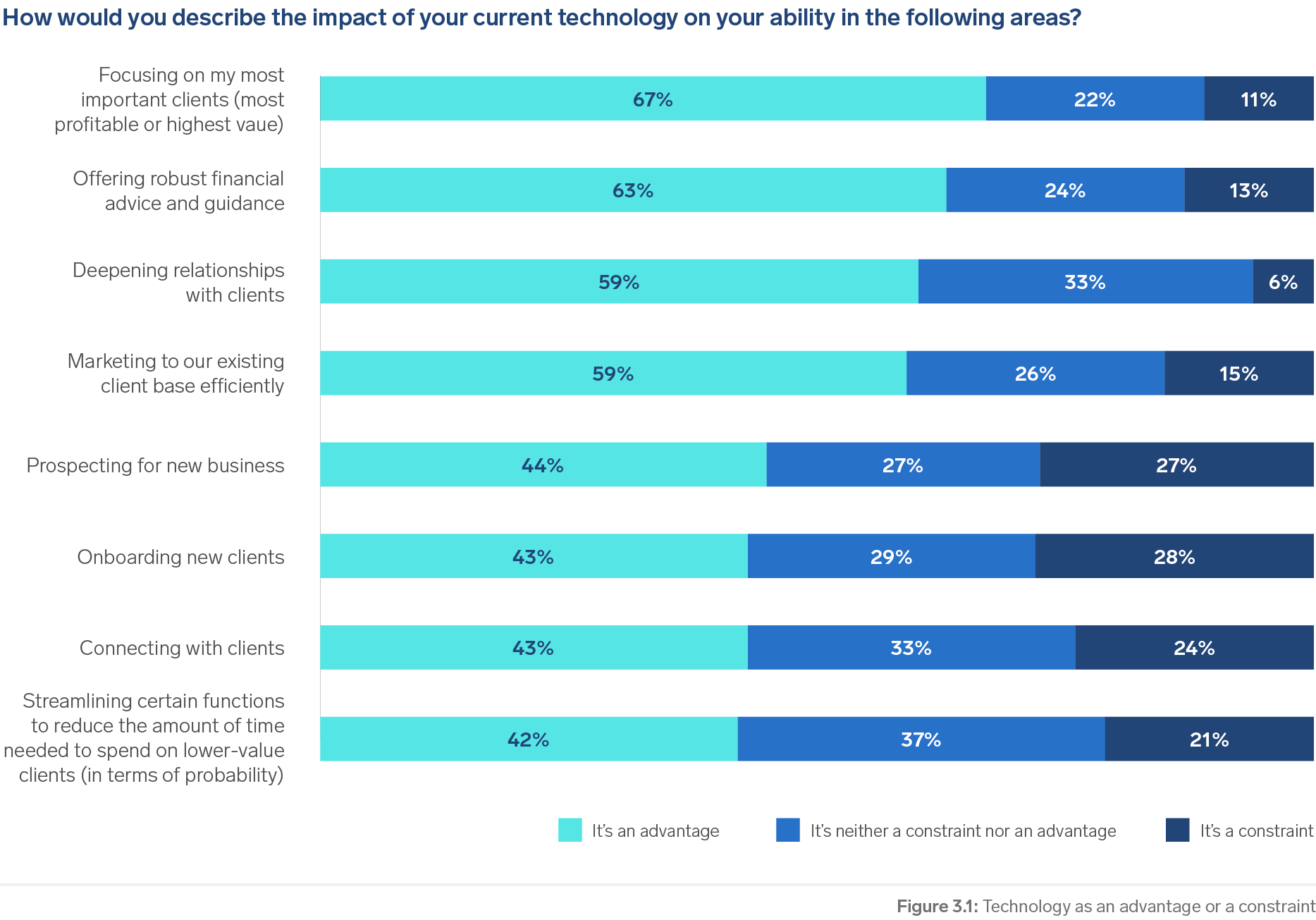

But review the table below. What is most important to you? What do you see as being the biggest time saver that can help you snatch back hours in your week that can be re-centered on your clients?

Source: Advisor360° 2022 Connected Wealth Report

Harnessing technology in advisor-client relationships can have a transformative impact. The right suite saves time and fosters deeper personal connections. With modern tech tools, advisors can spend more time with clients, build stronger relationships, and offer salient recommendations. This leads to increased referrals and improved business outcomes. Making technology integration a backbone of your practice is key to unlocking growth.

Dr. David Townsend, DBA, CFA, leads product marketing and thought leadership at Halo Investing. He’s responsible for helping advisors develop and articulate how portfolios can benefit from defined-outcomes and other alternative strategies.

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

AI has already proven it can make advisors more efficient. The next phase of adoption will be defined by something equally important: trust.

The rationale for AI governance in fintech firms and how Advisor360°TM approaches roles, responsibilities, and enablement.