This is the second installment in a series about what it takes to build an enterprise-class software company. You cannot build an enterprise-class software company without enterprise-class compliance with regulations. We combine deep wealth management domain expertise and enterprise software expertise to deliver frequent, innovative solutions configured for our clients’ businesses—all while keeping their data secure and private.

As Advisor360°’s General Counsel, I’m responsible for helping to create a culture of compliance throughout the entire organization. Compliance requirements are an essential element of all the capabilities that make up the Advisor360° platform; however, it is not enough for financial advisor software to simply comply with the rules. Enterprise-class software must exceed the requirements by truly reducing risks to our clients and their investors and creating efficiencies that save our clients time and money.

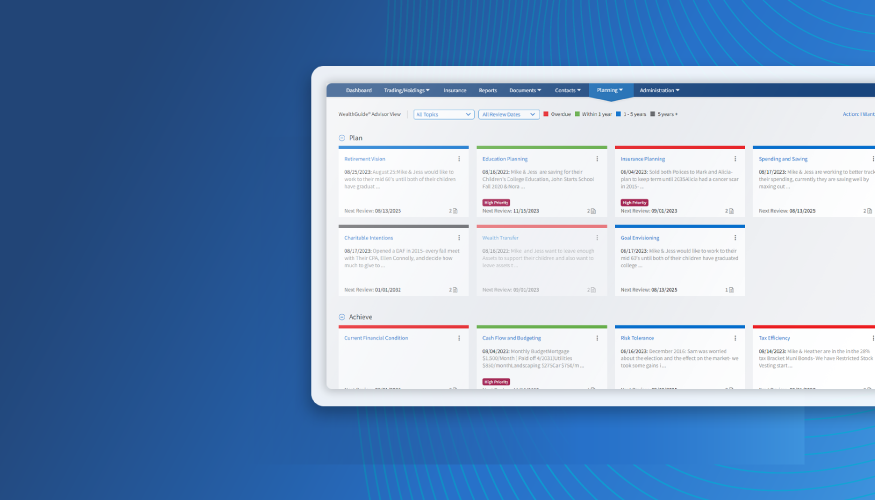

Advisor360°’s platform is designed for broker-dealers that take a risk-based approach to compliance. Our platform’s capabilities offer visibility into the compliance health of the firm by coordinating all alerts and exceptions back to the advisor.

Our compliance expertise

Financial services companies are subject to oversight by the Financial Industry Regulatory Authority (FINRA), the U.S. Securities and Exchange Commission (SEC), and state regulators. These regulators have created a complex and constantly changing landscape in which financial services companies must operate. Advisor360°’s platform is rooted in 20+ years of compliance built into every aspect of every application, webpage, and report.

Advisor360°’s product owners and engineers have developed extensive industry knowledge, and we constantly monitor proposed and final rule changes that may affect our clients. We subscribe to newsletters and alerts from FINRA and the SEC, the National Conference of State Legislatures, and dozens of law firms and other sources to ensure we are up to date on all the latest rules and regulations.

In addition, we continuously solicit feedback from our clients to ensure we are incorporating best practices into our compliance applications. Our clients have incredibly talented compliance personnel, and they partner with us to share what works for them, what challenges and pain points they face, and what enhancements they would like to see on our platform.

Moreover, we partner with independent industry compliance experts to supplement and enhance our compliance efforts. These independent experts present a fresh set of eyes to the compliance challenges our clients face. This outside perspective brings new ideas to the table and encourages innovation in our product design.

Rapid responses to rule changes

Advisor360°’s team looks two to five years into the future as we plan our product roadmap. We have proposed rule changes in mind as we look to enhance our platform, and even if the details of the final rules are still to be decided, we know our planning is headed in the right direction. In addition to our long-term planning activities, we also have regular code releases that allow us to quickly respond to rule changes. This is particularly important when regulators engage in “rulemaking by enforcement”—i.e., bringing an enforcement action against a broker-dealer or investment advisor that signals an unexpected interpretation of a rule that takes the industry by surprise.

Advisor360°’s ability to quickly react and adapt is also crucial for responding to changing client needs. For example, when clients launch a new product that introduces a novel risk, Advisor360° can quickly modify existing surveillance reporting or create new reports that allow our clients’ compliance departments to oversee that activity.

Adding value and creating efficiencies

People-intensive, manual, and inefficient compliance processes not only waste time and resources but also introduce additional risks and opportunities for human error. For example, surveillance reports that overwhelm compliance personnel with false positives can result in activity that should have been investigated slipping through the cracks. Another example is political contribution reporting where much thought went into understanding the business challenges of our client’s back office. Through thoughtful design, we were able to automate the most time-consuming tasks like aggregating contributions and proactively warning associates that a planned contribution exceeds company thresholds to reduce the burden on support staff and the advisor.

Risk reduction using powerful compliance

Compliance failures can introduce unacceptable regulatory and reputational risks to financial services companies. Enterprise-class software can reduce these risks with powerful compliance tools that not only meet regulatory requirements but also make users—compliance professionals, home office personnel, and financial advisors—more efficient and productive.

You might be interested in the first installment in this series, What it takes to build an enterprise-class software company.

Enjoying this series? Sign up to automatically receive our blogs as they are released.

Brendan Daly is Advisor360°'s General Counsel, responsible for ensuring the organization operates in a legal and ethical manner while meeting business goals and fulfilling the company’s mission.

Brendan Daly

Brendan Daly