From Buzzwords to Business Impact: Insights From FSI OneVoice 2026

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

Every day, each of us makes a number of decisions that affect our lives. (Research says the number of decisions is somewhere between 3,000 and 35,000; I couldn’t decide which source to trust, so I’m giving you the range instead!) In making these decisions—regardless of whether our choices involve something rather ordinary or matters of consequence—we attempt to optimize for something.

When it comes to financial wealth management technology, one of our core goals is to optimize our users’ time. By saving time, broker-dealers, advisors, and their staff gain efficiencies (e.g., cost savings) and productivity (e.g., the ability to focus on revenue-generating activities), along with more personal time to spend however they see fit.

In addition to optimizing the tools we build and support to save broker-dealers and advisors time, we believe we have an even higher calling: optimizing a platform for actual users via our user-centered design process. (Side note, you might be interested in this blog: Is your WealthTech platform designed for actual users?) That begs the question, “What leads to a great technology experience?”

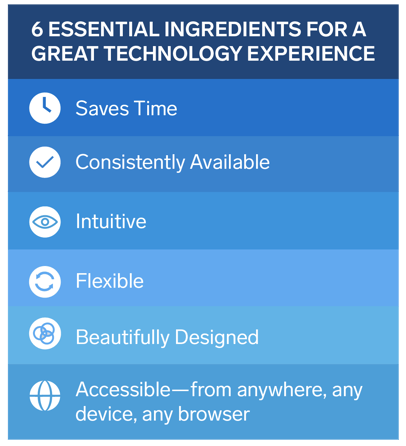

I believe these six ingredients are essential to create an amazing technology experience:

Tight integration between various applications is critical for maximizing time savings. Advisor360° views integration as:

Software should be easy to use, requiring as few clicks or swipes as possible for frequently used functions. Studies have shown that “intuitive” and “fast” are often interchangeable in a user’s mind; quick access can be just as important as page load speed.

Tools that are pleasing to the eye are more enjoyable than those that are not. For instance, the sleek design of Apple’s iPhone, combined with its intuitive nature, is often cited as the reason for the product’s epic success.

Systems must remain stable. You can have the most beautiful software in the world, but if it’s regularly unavailable due to system or server downtime, people will find alternatives.

Twenty-five years ago, tech companies had to worry about testing their software in Windows, Internet Explorer, and Netscape. In the age of advanced browsers, mobile applications, and remote connectivity, today’s technology companies must understand the new ways users want to access information and prioritize security.

While too much flexibility can overwhelm users, a one-size-fits-all mentality is also detrimental to the user experience. This is particularly important for independent broker-dealers that have to focus on advisors who are, well, independent in their thinking.

Optimization is in the eye of the beholder. Two people might perform the same action but do so for different reasons. One advisor might place a trade to buy IBM as a vehicle to maximize long-term growth, while another might buy the same stock for the company’s stability and the potential income stream it can generate.

Optimization isn’t black and white or wrong or right; it’s all about perspective. Many financial wealth management technology platforms have evolved to become browser-agnostic. Any web browser, enterprise, and financial advisor technologies must be user-agnostic to meet all broker-dealer and advisor needs, no matter how they choose to run a business.

Darren Tedesco is President of Advisor360° and has been part of our software development since its inception, bringing together the thinkers, creators, and visionaries that help power our clients’ productivity, profitability, and growth.

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

AI has already proven it can make advisors more efficient. The next phase of adoption will be defined by something equally important: trust.

The rationale for AI governance in fintech firms and how Advisor360°TM approaches roles, responsibilities, and enablement.