From Buzzwords to Business Impact: Insights From FSI OneVoice 2026

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

The CFP® board has outlined a seven-step financial planning process to help guide CFP certificates through the planning process with their clients and prospects. In this series of four blogs, I am going to show you how Advisor360°'s platform helps facilitate this process by providing efficiency and an enhanced client experience.

In this blog, I will discuss step one of the seven-step financial planning process: understanding your client’s personal and financial circumstances.

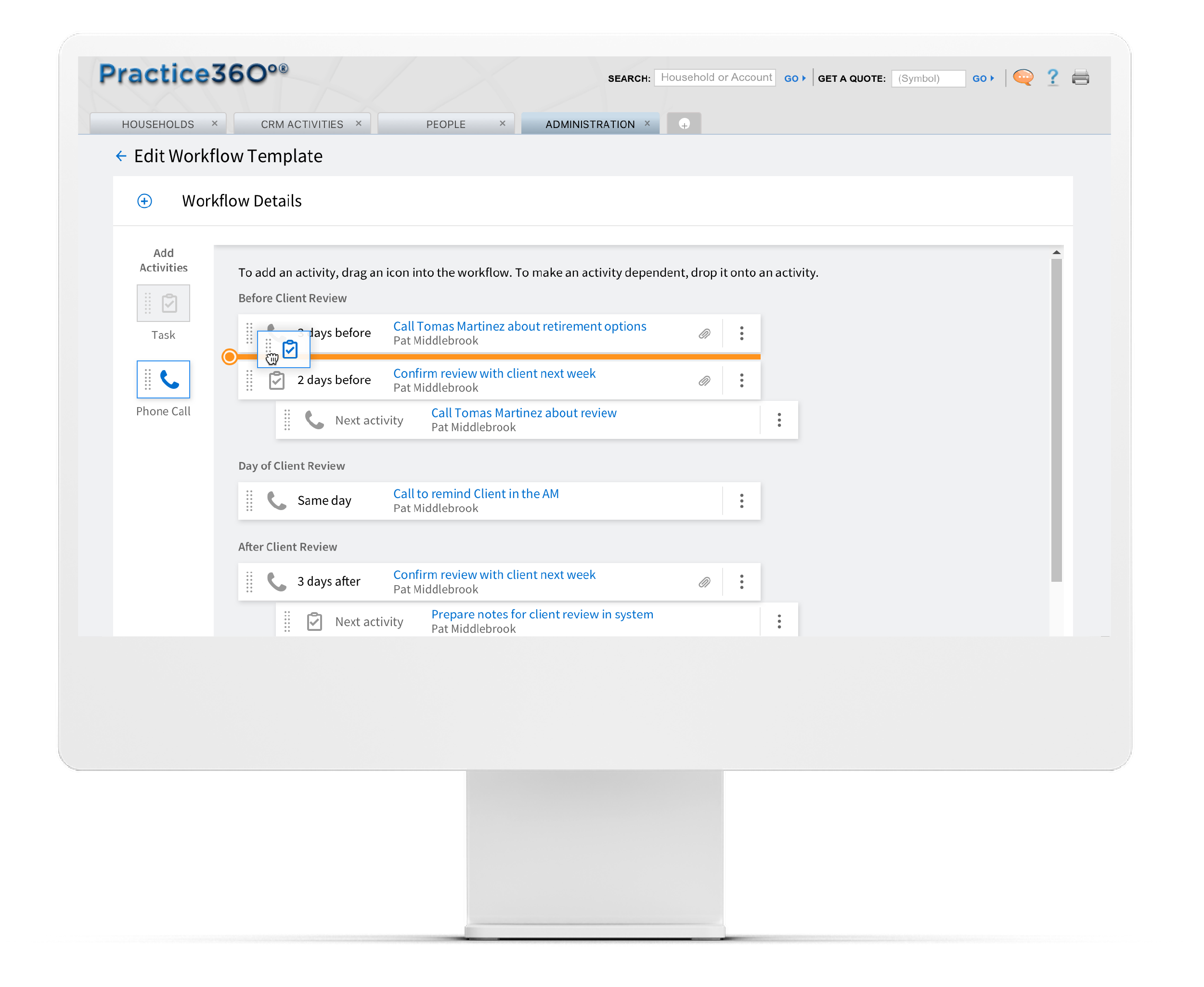

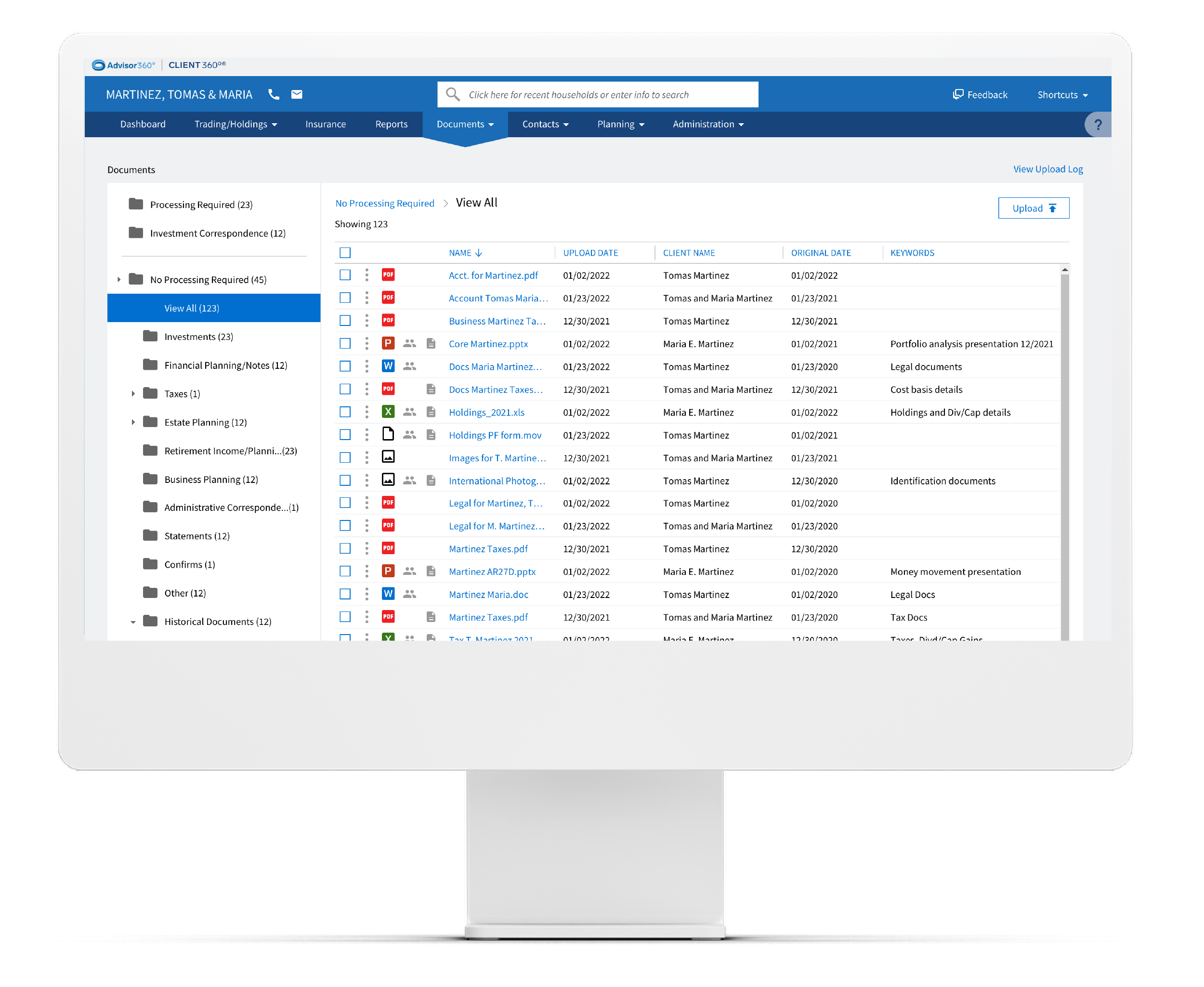

The first phase of Step 1 is to assign your client or prospect to your configurable new client workflow. Workflows will assist you and your clients through the necessary steps of gathering and storing data. Below are a few activities that can be included in a workflow.

Now that we have gathered the necessary information to properly understand your client’s current financial situation, we can move on to identifying, analyzing, developing, and presenting their goals. These are steps two, three, and four, and will be covered in next week’s blog.

Patrick Noonan is Product Manager for Wealth Management and Insurance. Backed by his years of experience as a Certified Financial Planner (CFP®), Patrick defines and oversees product features that improve broker-dealer, advisor, and investor performance and efficiencies in the banking, investment, and insurance industries.

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

AI has already proven it can make advisors more efficient. The next phase of adoption will be defined by something equally important: trust.

The rationale for AI governance in fintech firms and how Advisor360°TM approaches roles, responsibilities, and enablement.