RIA 2.0: Less Paperwork, More Personal Connections

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

3 min read

Rob Bateman

:

10/15/25 10:11 AM

Rob Bateman

:

10/15/25 10:11 AM

Independent advisors face a constant balancing act: how to grow their practices without losing the personal connection that sets them apart. In a recent webinar, Trust at Scale: A New Growth Playbook for Independent Advisors, Rob Bateman of Advisor360° and Iyana Harris of Catalyst shared their perspectives on the challenges and opportunities facing RIAs today. Below are excerpted highlights from their conversation.

[CLICK HERE TO WATCH THE FULL WEBINAR REPLAY]

The Growth Trap: More Demands, Fewer Hands

Rob: Independent advisors wear two hats—they’re business owners and wealth managers. That balance is tough as client expectations rise and a massive generational wealth transfer—call it $60–$90 trillion—reshapes the landscape. At the same time, we could see around a hundred thousand advisors leave the business in the next decade. More demand, less supply. Meanwhile, the goal is to grow clients, not workload.

Iyana: Agreed. And firms without true succession plans feel it first. At Catalyst, we address this by pairing established advisors with next gen advisors or career-changers—people who are comfortable with technology and open to AI. If you don’t cultivate the next generation, you’ll lose the talent game and stall growth.

Rob: Exactly. And technology can fill in some gaps. If you’re independent, you can have your cake of independence and eat it too with enterprise-level resources—provided your platform is integrated and set up to scale.

What Independent Advisors Won’t Compromise

Iyana: Advisors aren’t giving up control, culture, or the client experience. Clean data, autonomy of advice, and a concierge-like experience are non-negotiables. Firms that create community and share infrastructure—without surrendering the client relationship—are winning.

Rob: When asked about the benefits of tech, advisors put quality and client experience first. Efficiency comes after. The point isn’t to cut headcount; it’s to deliver better advice at scale. Track the right things: time with clients and prospects, referrals, NPS, CSAT—not just AUM.

Iyana: Scale doesn’t come from headcount anymore. It’s repeatability and experience. If your stack isn’t giving you hours back with clients, find a partner who will.

Rob: And design for the household, not just the account. You’re not a stock picker; you’re a life coach. Know the next generation, the insurance picture, the beneficiaries—so you’re building relationships before decisions get made elsewhere.

Tech Solutions and Blockers

Rob: Advisor sentiment toward generative AI is moving fast. In our 2025 Connected Wealth Report, those who said AI would help their business jumped from 65% to 88% in a year, and those who saw AI as a threat dropped from 21% to 8%. But two blockers keep coming up: bad data and poor integrations. Four out of five advisors say their stack isn’t fully integrated, and 43% point to stale or inconsistent data dragging them down.

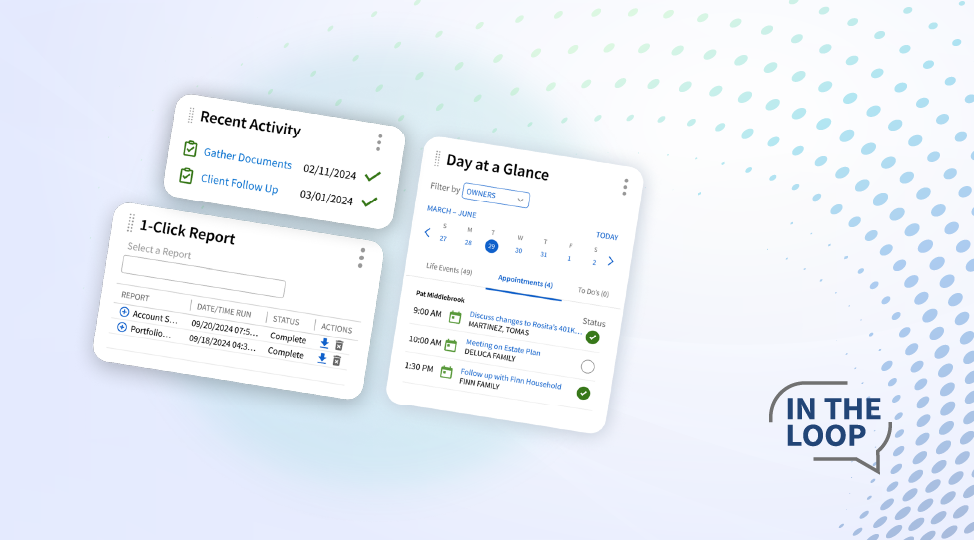

Iyana: That’s exactly what I hear. Poorly integrated tech is a top reason advisors change firms. They don’t want a fragmented experience where systems can’t talk to each other. Advisors want to move from task to task—and client to client—without friction.

Rob: AI helps. Low-threat use cases—like meeting summaries—are no-brainers. They don’t replace judgment; they free you to actually interact with clients. But unless data is unified and systems connect, you won’t see the upside.

Leading Forward: Best Next Steps

Iyana: High on my list is to think like a founder, not just a practitioner. Build G1-G2-G3 teams. Pair seasoned rainmakers with tech-savvy next-gen advisors—trade wisdom for speed.

Rob: Building on that, future-proofing isn’t optional. Assess your tech stack: are integrations real, is your data clean? And read the Connected Wealth Report. Then compare your sentiment and decide—buy, build, or partner.

Iyana: I'm also big on assessment and 30-60-90 day plans. Over the first 30 days, audit your workflows—from onboarding and RMDs to cash movement, account changes, and meeting prep—time clicks, minutes, and hours to determine where the bottlenecks are. By day 60, turn outward: clarify the story you share with clients, define a target client persona, create a one-page client brief of your services, and build a concierge approach for both do-it-yourself and done-for-you clients. At 90 days, take your findings to your firm and ask for the tech to fix the inefficiencies. If they can’t help, consult peers and, if needed, a specialist to find a partner firm that meets your needs so the practice can grow more efficiently.

Rob: Winning tech makes more room for the human touch. Let portals and data sources surface client behavior so you can know your clients’ needs. That’s trust at scale—more proactive conversations, the same high-quality advice.

Rob Bateman is Director of Product Marketing at Advisor360°. Iyana Harris is Co-founder of Catalyst.

If these ideas resonate with you, schedule a fast and easy demo to see how Advisor360° could improve your practice. Message Iyana on LinkedIn for a consultation.

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Picture this: You’re prepping for a client meeting—switching between several systems at once to locate client details, account balances, and...

According to our 2025 Connected Wealth Report, 85% of advisors believe generative AI will help their business—that’s up from 65% in 2024.