RIA 2.0: Less Paperwork, More Personal Connections

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

We live in a world of intelligent technology. The apps we use for travel, shopping, fitness, and healthcare remember preferences, anticipate needs, and respond quickly. Our lived experience has reshaped what we expect from every digital interaction.

In wealth management, those expectations now shape trust between advisors and clients. Clients want tools that are as smooth and familiar as the ones they use to order dinner or download music. They are accustomed to using technology that understands their preferences, stays one step ahead of their search queries, and makes their financial life easier to grasp. When the experience feels intuitive and predictable, advisor-client trust grows. When it feels dated or disjointed, it fades.

Usability has become a measure of credibility. If a client portal or wealth platform cannot reliably deliver the information clients need at their fingertips, they begin to question whether the firm behind it can keep up.

Next-generation clients expect personalization, speed, and relevance with minimal friction. They notice when a platform repeats questions, when information does not line up, or when they have to dig for what should be served up. They also notice when a system feels familiar–when the next step appears at the right moment, and when the right insight is already on the screen.

Emotional and behavioral design at work

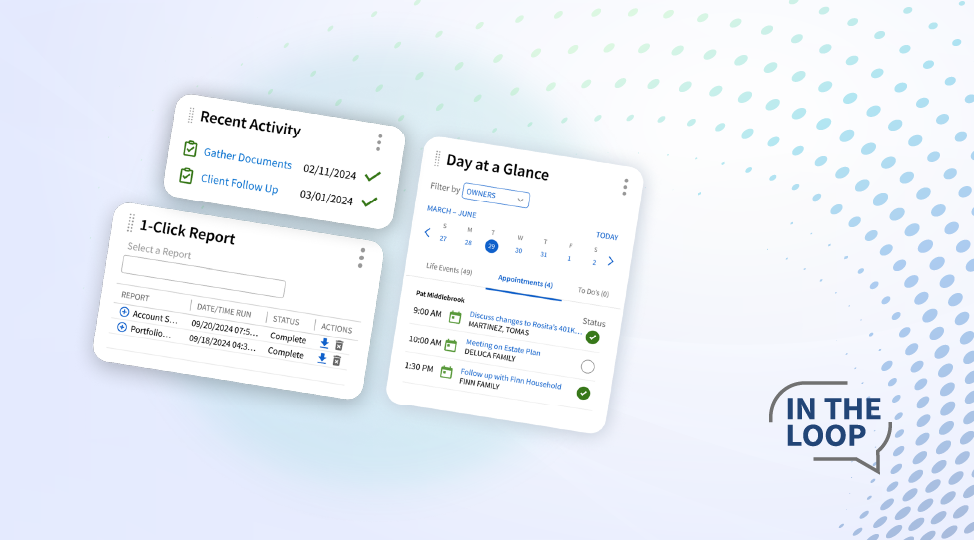

At Advisor360°, we believe the new era of client experience will be built on personalization, predictability, and connection. By combining behavioral and emotional design with unified data and modern architecture, we are creating client and advisor experiences that are not only intelligent but also familiar. Advisors and clients see what they need, when they need it, in a format that feels intuitive.

Clarity and context are two behavioral and emotional design principles we use every day. They reflect how people naturally process information and help organize complex data in ways that reduce friction.

- Clarity that reduces cognitive load: We’ve moved past the era when people expect to hunt for information. Now, our platform understands where someone is in their day, their budget cycle, or their fiscal year and adjusts what it shows in that moment. The most relevant data presents itself, so clients spend less energy searching and more energy deciding. When dashboards anticipate their next question, highlight their next best action, and pair information with plain language explanations, the experience feels lighter, clearer, and easier to trust.

- Context that personalizes relevance: Personalization has evolved into something deeper, grounded in what feels relevant to each client in the moment. Our behavioral design approach shapes experiences around real goals, life stages, and risk profiles, so the journey feels built for each individual.

For example, a recently retired client won’t move through the same portal experience as someone in their peak earning years who’s saving for their child’s education. Tone, prompts, and visual focus shift to match where they are in life. When technology like ours uses cues such as past actions and timing to surface the right insight in context, the experience stops feeling generic and starts to feel intuitive.

Falling behind in client experience has real consequences. Slow, confusing, or fragmented systems erode trust and push clients toward competitors whose tools feel more like the apps they already rely on. The next generation of clients will not separate strong advice from a strong experience. They expect both.

At Advisor360°, we’re building for that future today. Our focus is on unifying data, reducing friction, and creating experiences that feel clear and intuitive—so advisors can focus on their clients, their conversations, and the decisions that matter most.

If the above points resonate with you, I invite you to schedule a fast and easy Advisor360° demo to see for yourself how it works. In the meantime, visit our website or follow us on LinkedIn.

Caitlin Rouille is Director of Product Design at Advisor360°

Advisor360°’s 2025 Connected Wealth Report confirmed what we all suspected: technology will make or break your business. In fact, 86% of advisors...

Picture this: You’re prepping for a client meeting—switching between several systems at once to locate client details, account balances, and...

According to our 2025 Connected Wealth Report, 85% of advisors believe generative AI will help their business—that’s up from 65% in 2024.