From Buzzwords to Business Impact: Insights From FSI OneVoice 2026

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

2 min read

Advisor360° : 12/13/23 8:34 AM

We recently released the latest installment of our award-winning Connected Wealth Report series—AI and the Next-Gen Advisor, a survey of 300 next-gen financial advisors that explores their perspectives on AI and its impact on the wealth management industry.

It’s not surprising that Artificial Intelligence (AI) became a dominant theme in 2023—most people saw that coming in the wake of ChatGPT’s launch late last year followed by the meteoric rise of generative AI across industries. What is surprising is how younger wealth advisors feel about AI.

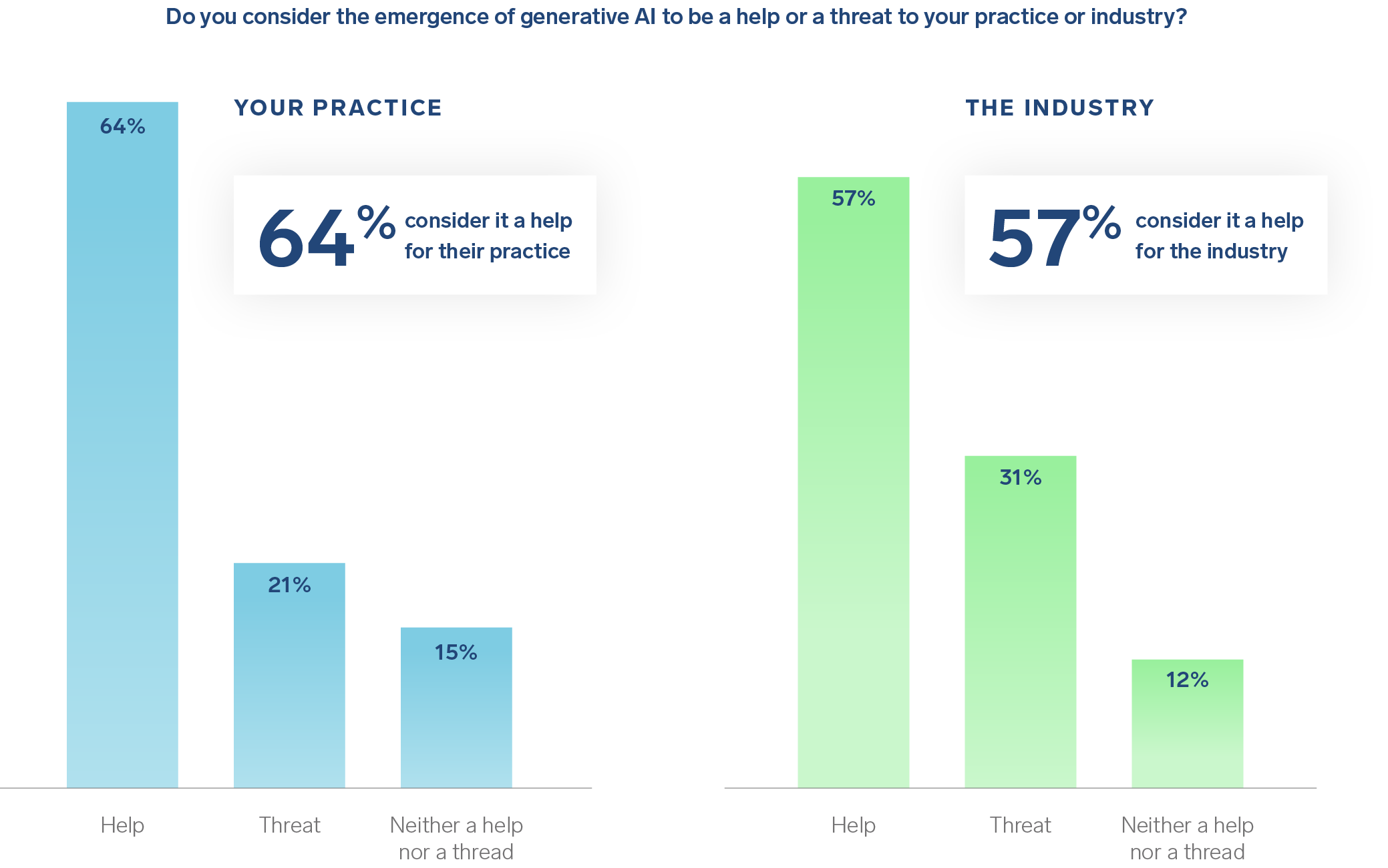

Despite the onslaught of news about AI’s ability to usurp jobs, the advisors surveyed in our 2024 Connected Wealth Report: AI and the Next-Gen Advisor were largely optimistic about the potential of AI to aid their efforts to serve clients and build their business.

Advisor360° President Darren Tedesco put it this way: “The results of the survey yielded thought-provoking and sometimes unexpected findings. Ultimately, the report offers an early and important glimpse into the desires and expectations of Next Gen advisors—including the expectation to integrate AI into the technological infrastructure of their firms.”

Our survey of 300 mid-career financial advisors and executives in enterprise wealth management firms found that nearly two-thirds of advisors are onboard with AI, with most feeling that it will help their business.

In addition to their upbeat sentiment about AI, the survey also revealed that advisors believe it has the potential to streamline many facets of their day-to-day business—more than 84% see AI-enabled tools and automation benefiting wealth management in the front-office, back-office, or both.

Just 16% of these next-gen advisors fail to see the value of AI for themselves or their firm. So, where’s the rub? According to our survey, enterprise wealth firms have some work to do to make AI useful for advisors. Respondents reported that bad data is the biggest hurdle in their existing tech setups—which could spell trouble for firms.

According to Tedesco, “Data quality is paramount for AI adoption. In fact, if the data underlying AI is unreliable, the software itself is inherently flawed, making AI-automated client workflows less effective, or much worse, outright dangerous.”

A second cautionary theme emerging from our survey is the need to construct guardrails at the strategy development and policy creation levels to guide the use of AI. A majority of advisors said that AI was “unchartered territory.” A surprisingly high 97% of advisors reported that their firm has an AI strategy, yet just over half said that advisors were meaningfully involved in the process.

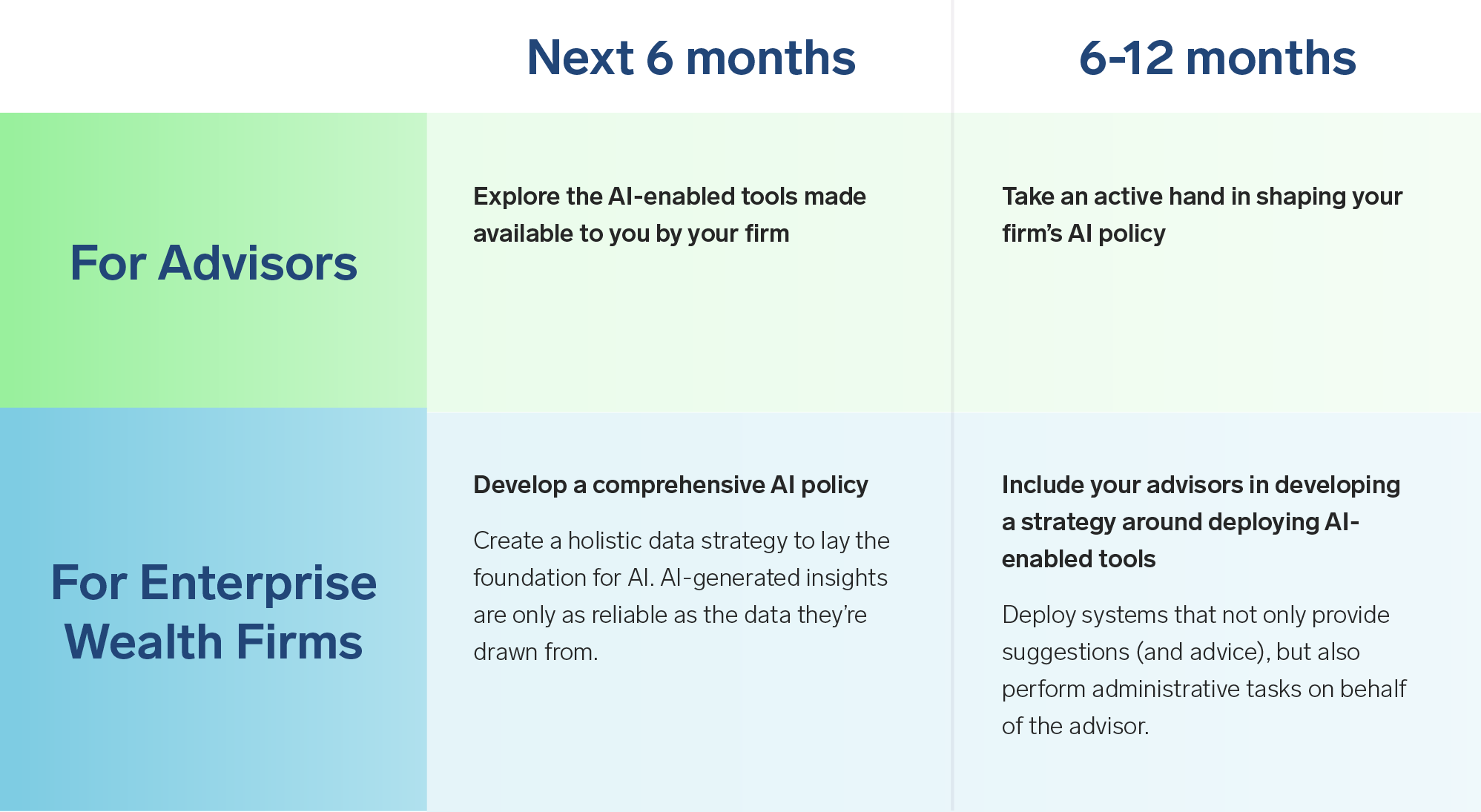

Our report’s findings underscore the need for wealth managers and industry executives to be active in shaping how this emerging technology will be leveraged so that everyone benefits—advisors, clients, and firms.

In the meantime, we identified steps that advisors and firms can take to start incorporating AI into how they work.

Read the full 2024 Connected Wealth Report: AI and the Next-Gen Advisor for many more trends and insights.

As part of our award-winning Connected Wealth Report research, we surveyed 300 financial advisors and executives at large broker-dealers, registered investment advisors and bank trust companies across the U.S. for their perspective on the impact of artificial intelligence (AI) on their business and the industry. Survey participants were employed by enterprise wealth management firms with an average of $9 billion in assets under management and more than 1,000 employees. Respondents to the telephone to web-based survey were 36.5 years old on average with an average of $40 million in assets under management. The survey was fielded between September and October 2023 by Coleman Parkes Research on behalf of Advisor360°. Advisor360° and Coleman Parkes are separate and unaffiliated organizations.

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

AI has already proven it can make advisors more efficient. The next phase of adoption will be defined by something equally important: trust.

The rationale for AI governance in fintech firms and how Advisor360°TM approaches roles, responsibilities, and enablement.