From Buzzwords to Business Impact: Insights From FSI OneVoice 2026

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

Advice360° is a series designed to help advisors increase their productivity using our digital wealth management software.

In this installment, Meredith Connell, Advisor360°’s Sr. Product Manager of Wealth Management, explains how our solutions can help unlock advisor productivity throughout the wealth management process.

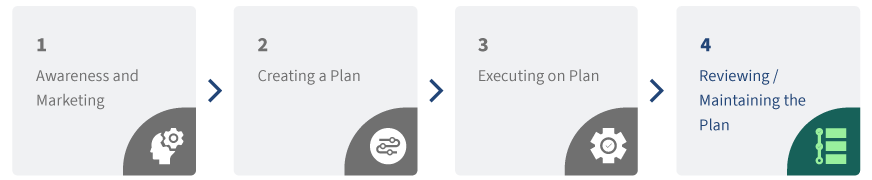

In part one of this blog series, my colleague Patrick Noonan focused on how our technology unlocks advisor productivity while they are marketing their practice and creating financial plans.

Today, I’m going to focus on the next two facets of helping clients reach their financial goals—executing the plan and monitoring its progress—and how our solutions increase efficiency and give advisors time back in their busy day.

Once a financial plan has been created and shared with the client via our Client Portal, advisors need to turn toward executing the plan they’ve laid out. Our solutions inject productivity throughout this workflow, which is carried out using our Digital Onboarding and Managed Accounts solutions:

Account funding is now complete, and the advisor needs to periodically review both the performance and activity of the accounts, as well as develop the advisor-client relationship. Because this workflow is ongoing, the advisor must be able to efficiently review, supervise, and maintain the client’s financial plan—and our Data and Reporting, Advisor Experience, and Digital Onboarding solutions do just that.

At the end of the day, technology has the power to increase success and productivity, leaving both advisors and their clients satisfied.

That’s why Advisor360° takes pride in building and delivering a configurable set of solutions that infuses efficiencies throughout the wealth management process, providing firms and advisors the resources for long-term success.

Meredith Connell is a Sr. Product Manager for Wealth Management. As a Certified Financial Planner (CFP®), Meredith defines and oversees product features that improve advisor, investor, and home office efficiencies, with a focus on Digital Onboarding capabilities.

At FSI OneVoice this year, the most interesting conversations weren’t about any single product or announcement—they were about how fundamentally the...

AI has already proven it can make advisors more efficient. The next phase of adoption will be defined by something equally important: trust.

The rationale for AI governance in fintech firms and how Advisor360°TM approaches roles, responsibilities, and enablement.